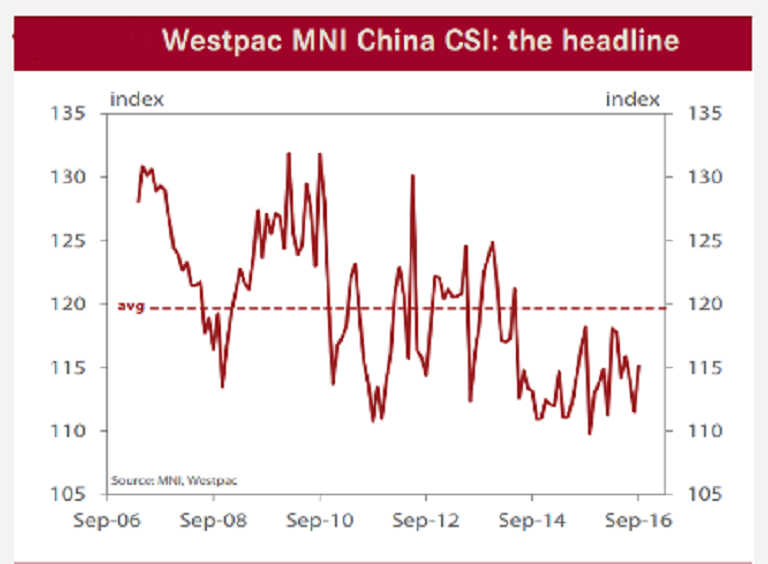

China’s consumer sentiment recovered during the month of September, although remaining well below the long-run average of 120, but is slightly above the average read over the last 12 months.

The Westpac MNI China Consumer Sentiment Indicator recovered in September, rising 3.3 percent to 115.2 from 111.5 in August. All five components improved in September. Consumers’ near-term expectations recorded the strongest gains: ‘family finances next 12 months up 7.1 percent and ‘business conditions, next 12mths’ up 4.9 percent.

Further, assessments of ‘business conditions, next 5 years’ recorded a milder 2.6 percent rise with views on ‘family finances vs a year ago’ up 1.3 percent and assessments of ‘time to buy a major item’ up just 0.7 percent. Notably, all components remain materially below their long-run averages.

Chinese consumers also marked up their assessment of current business conditions: the ‘business conditions vs a year ago’ index up 4.6 percent and basically in line with long-run average. Job security recorded a particularly strong rebound, the employment indicator surging 8.0 percent more than reversing last month’s 7.4 percent drop.

Meanwhile, this month’s rebound in confidence is clearly a welcome development, particularly after the sharp slide in June-August. However, even with a recovery, sentiment is still at a low level overall and yet to establish a convincing recovery.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound