Australia has acted with dismay to China’s decision to impose punitive mostly “anti-dumping” tariffs of 80.5% on imports of Australian barley.

The culmination of an 18-month investigation, China’s move threatens to wipe out Australian barley exports to China, worth A$600 million in 2019, unless China withdraws the measure either unilaterally or following a successful challenge at the World Trade Organisation (WTO).

However poorly justified, there are precedents for what China has done, many of them from Australia.

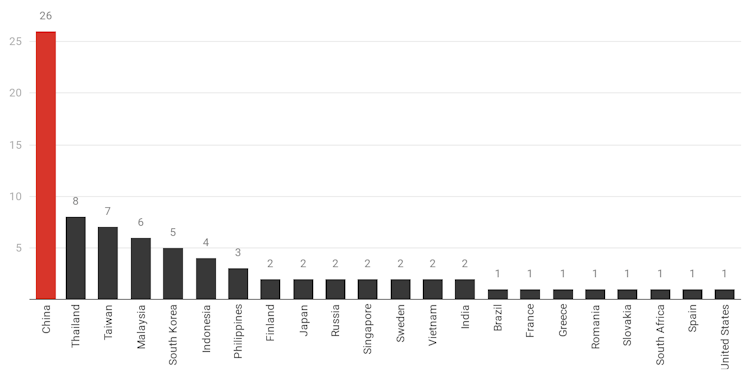

Australian anti-dumping and countervailing measures by country, March 2020

Anti-Dumping Commission, March 31, 2020

Australia was among the first wave of countries to adopt anti-dumping legislation alongside Canada, New Zealand, the United States and Britain in the early years of the 20th Century.

It remains a prolific user of the system compared to other countries, with an outsized number of measures imposed against imports from one country, China, and imports of one product, steel.

What are anti-dumping measures?

One way to think about anti-dumping measures is the international equivalent of domestic measures intended to combat predatory pricing.

Guidance from the Australian Competition and Consumer Commission says that while it is usually okay to sell goods at a below-cost price, “it may be illegal if it is done for the purpose of eliminating or substantially damaging a competitor”.

But in the case of international anti-dumping measures, there is no need to prove purpose.

It suffices that an investigation finds the imported goods were sold below their corresponding price in the home market and that this caused or threatened to cause harm to a domestic industry producing the same sort of goods (known as “like products”).

Chinese steel, glass, cables and A4 copy paper

Technically, Australia imposes two types of measures: “anti-dumping measures”, which are additional duties on so-called dumped imports which are held to have injured Australian industry, and “countervailing measures” which are additional duties on subsidised imports that have injured Australian industry.

They are currently in place or proposed against Chinese wind towers, glass, electric cables, chemicals, herbicides, A4 copy paper and aluminium products, as well as steel.

In theory, WTO rules only allows anti-dumping measures for limited periods (China’s measures on barley have been imposed for five years) but in practice, once in place these measures can be difficult to remove.

They shield us from cut-throat competition

In the broader context of Australia’s relationship with China, they play an important role, shielding Australian import-competing industries from the full and potentially crushing impact of free trade with China.

One aspect of their use that has been particularly galling to Chinese officials is Australia’s failure to follow through on a commitment it made during the China-Australia Free Trade Agreement negotiations to treat China as a market economy for the purpose of anti-dumping investigations.

The concession was seen as highly significant by China and would have made it harder for Australia to conclude that some goods were not being sold at fair prices.

Australia’s continued use of anti-dumping measures has come under repeated criticism from the Productivity Commission, almost entirely on the basis of economic efficiency arguments.

However, these criticisms ignore a number of important concerns, including the need to keep these measures so they can be used to hit back against other countries that use them. It would make little sense to remove them until other big users agreed to do the same.

Another important consideration, which has received greater attention during the current coronavirus crisis, is the need for – systemic resilience. If Australia becomes totally reliant on other countries for (say) steel, it’ll have less ability to get it when it is needed.

Before asking ourselves whether we are prepared to liberalise or do away with our current anti-dumping regime, we need to be able to answer the very important question of whether we are equally prepared to do away with our domestic steel, aluminium, paper and other industries.

I suspect that the answer to this question is no.

There are of course other ways to reinforce these industries or shield them from import competition, but it is more than likely that none would be as effective as the current system of anti-dumping duties. We have kept them because we still have some use for them.

Court Allows Expert Testimony Linking Johnson & Johnson Talc Products to Ovarian Cancer

Court Allows Expert Testimony Linking Johnson & Johnson Talc Products to Ovarian Cancer  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding

Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  U.S. Condemns South Africa’s Expulsion of Israeli Diplomat Amid Rising Diplomatic Tensions

U.S. Condemns South Africa’s Expulsion of Israeli Diplomat Amid Rising Diplomatic Tensions  Citigroup Faces Lawsuit Over Alleged Sexual Harassment by Top Wealth Executive

Citigroup Faces Lawsuit Over Alleged Sexual Harassment by Top Wealth Executive  Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns

Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns  New York Judge Orders Redrawing of GOP-Held Congressional District

New York Judge Orders Redrawing of GOP-Held Congressional District  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Google Halts UK YouTube TV Measurement Service After Legal Action

Google Halts UK YouTube TV Measurement Service After Legal Action  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Supreme Court Signals Skepticism Toward Hawaii Handgun Carry Law

Supreme Court Signals Skepticism Toward Hawaii Handgun Carry Law  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case

US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case  Trump Family Files $10 Billion Lawsuit Over IRS Tax Disclosure

Trump Family Files $10 Billion Lawsuit Over IRS Tax Disclosure  California Sues Trump Administration Over Federal Authority on Sable Offshore Pipelines

California Sues Trump Administration Over Federal Authority on Sable Offshore Pipelines