In a Shanghai warehouse, Chinese startup AgiBot is training humanoid robots to perform everyday tasks like folding clothes and making sandwiches. Operating 17 hours a day, the site collects crucial data to enhance the robots' AI capabilities. This effort is part of China’s broader push to become a global leader in humanoid robotics, spurred by economic challenges such as population decline, trade tensions, and slowing growth.

President Xi Jinping’s recent visit to AgiBot highlighted Beijing’s commitment to advancing robotics as a pillar of its next industrial revolution. Backed by over $20 billion in government funding and an additional 1 trillion yuan ($137 billion) AI and robotics fund, the sector is rapidly scaling. Local governments are also contributing, offering subsidies, free workspace, and support for new data collection centers.

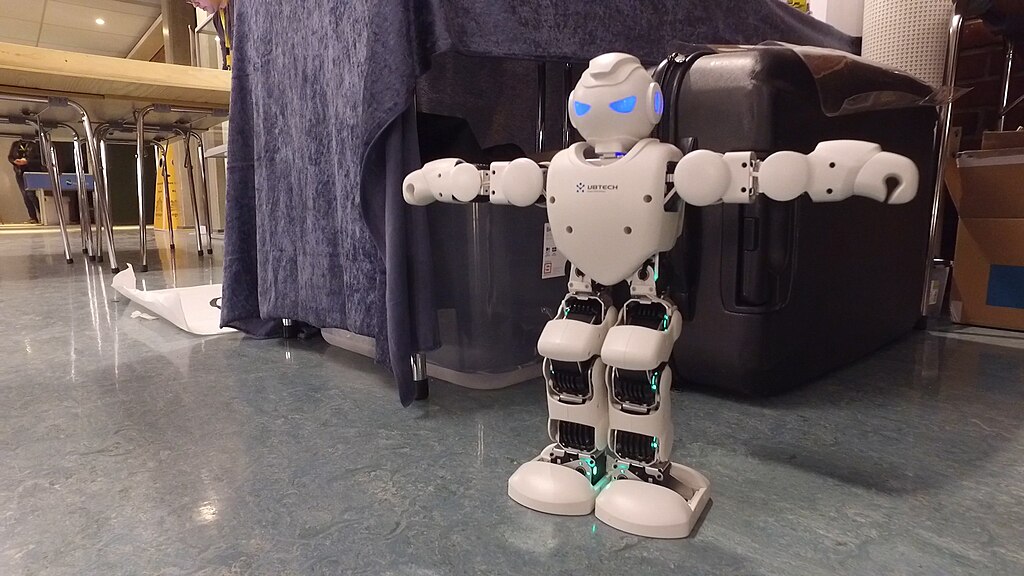

With China capable of producing up to 90% of humanoid robot components, domestic firms like Unitree, MagicLab, and UBTech are entering mass production. Robots are now being tested on factory floors for tasks like quality checks and material handling. The cost of humanoids is expected to fall from $35,000 to $17,000 by 2030, potentially driving mass adoption similar to the electric vehicle boom.

AI firms like DeepSeek, Alibaba’s Qwen, and ByteDance’s Doubao are helping power these robots’ “brains,” enabling real-world applications. While automation raises concerns about job displacement in China’s 123 million-strong manufacturing sector, the government is exploring solutions like AI unemployment insurance. At the same time, humanoid robots are being positioned to address labor shortages in elder care.

As China pushes to dominate humanoid robotics, its integration of data, AI, and supply chain efficiency could redefine global manufacturing and workforce dynamics.

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit