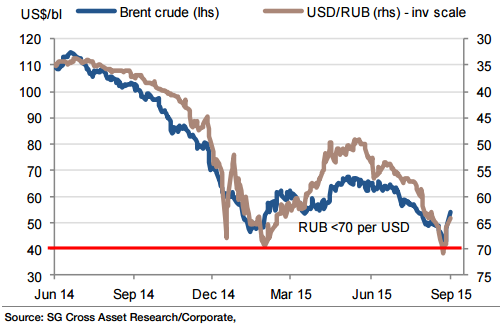

Global risk aversion and the fall in oil prices have pushed the RUB below 70 per USD. The possibility of a rate hike by the Central Bank of Russia is not ruled out and this is caused to initiate a 1y cross-currency payer trade at 13.05% targeting a move higher to 16.00%, says Societe Generale in a research note to its client.

Corporate borrowers hurt by sanctions face additional burden of $61bn of foreign debt repayments over the next four months (USD buying needs).The CBR has offered loans to help lighten the cost, alleviating pressure on the RUB.

The economy contracted 4.6% yoy in Q2, July CPI edged up to 15.6% from 15.3%. A recent Bloomberg survey shows: 63% of economists expect the CBR will intervene if oil prices fall below $40pbl while 47% see an emergency rate increase, notes SocGen.

CBR on alert to counter market instability

Friday, September 4, 2015 4:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence