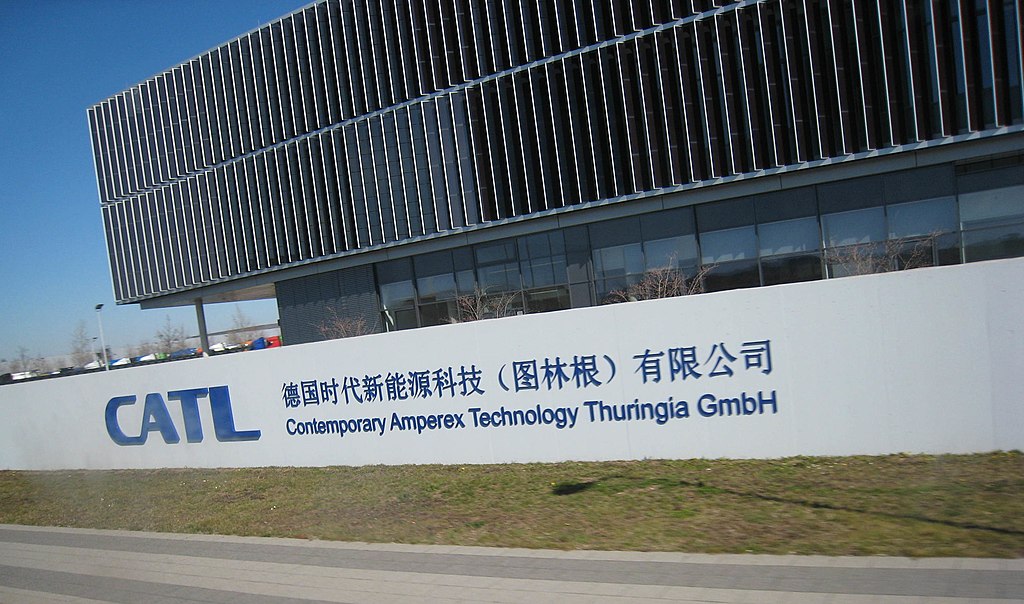

Chinese EV battery giant Contemporary Amperex Technology Co. Ltd. (CATL) is aiming to raise HK$31.01 billion (US$3.99 billion) through a Hong Kong listing, marking the city’s largest IPO so far this year. According to its prospectus filed on Monday, CATL will offer 117.9 million shares at a maximum price of HK$263 each. If overallotment and adjustment options are exercised, the deal could grow to US$5.3 billion.

Over 20 cornerstone investors—including Sinopec and the Kuwait Investment Authority—have committed to buying about US$2.62 billion worth of shares. The offering will allocate 109.1 million shares to institutional investors and 8.8 million shares to retail investors.

Final pricing is expected by May 19, with trading set to begin on May 20 on the Hong Kong Stock Exchange. If priced at the upper limit, shares would trade at a slight discount to CATL’s Shenzhen-listed stock, encouraging demand.

The company was recently listed by the U.S. Defense Department as having links to China’s military, a claim CATL denies, calling it a “false designation.” While U.S. onshore investors are barred from participating, their offshore affiliates can still join.

CATL has emphasized that U.S. tariffs will have limited impact due to the small proportion of its business in North America. The firm is also working with automakers like Ford and Tesla by licensing its battery tech rather than directly manufacturing in the U.S., a move criticized by some American lawmakers.

The IPO comes amid easing tensions in U.S.-China trade talks, though high tariffs remain. CATL said it will continue monitoring evolving trade policies to assess potential risks.

This listing follows Midea Group’s US$4.6 billion raise last year, making CATL’s deal a major milestone in 2025's IPO landscape.

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe