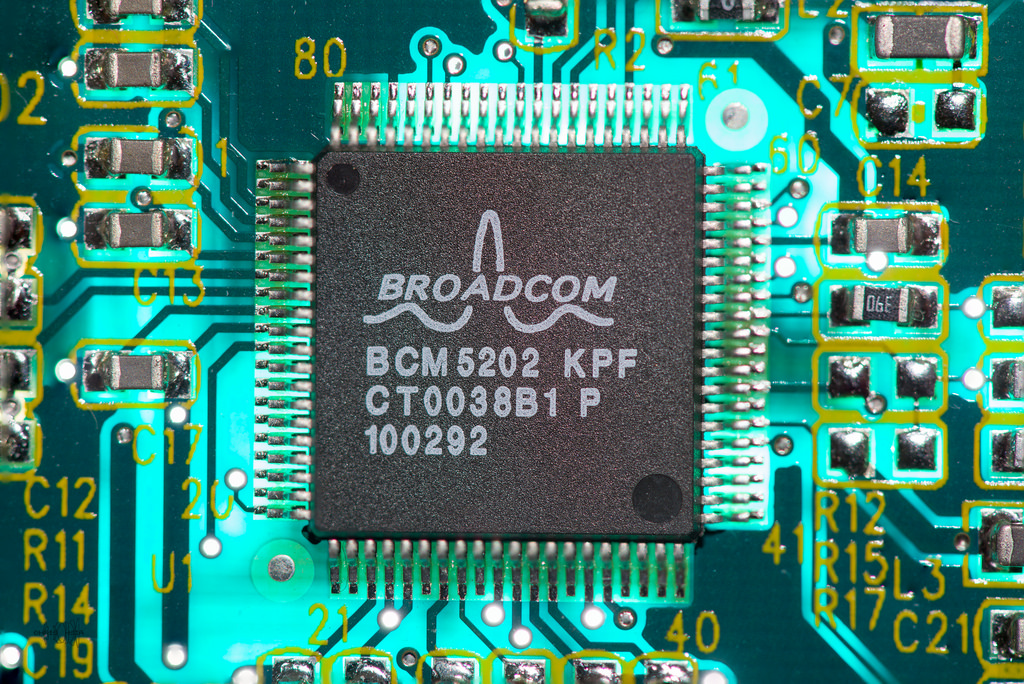

At face value, $121 billion might seem like a lot of money, but this doesn’t seem to be the case with everyone. Specifically, this amount of money didn’t faze investors of the giant chip maker Qualcomm when it was offered by another chip making company, Broadcom. The latter has been trying to buy the former since last year, with the latest offer being quite a bit bigger than the previous $105 billion placed on the table.

Broadcom made its new offer on Monday, The Wall Street Journal reports, placing the amount at $82 a share. The money would be paid partially in cash and the rest in stock, with the ratio kept relatively the same as last time. This could potentially be the single biggest technology deal in history, but it seems that it’s just not enough to convince the investors.

This is a bit confusing to the owner and CEO of Broadcom, Hock Tan, who can’t seem to understand why the deal isn’t being finalized right now. $121 billion is a huge amount of money and investors are supposed to like money.

“Any rational board would consider what we’ve put forward,” Tan told The New York Times over the phone.

With regards to what this deal could potentially mean, an acquisition would create one of the biggest monopolies in the tech industry. Qualcomm currently provides the components to a majority of smartphones and mobile devices being manufactured and this is despite its current legal spat with Apple.

If Broadcom does end up acquiring its target, it could mean that no other competitor could come close to touching the company in terms of the territory it could cover. Of course, there are no guarantees since trouble could be brewing for Qualcomm right now.

According to recent predictions by analysts, Apple could start relying only on Intel for its chips moving forward. This which would put Qualcomm in a tight spot.

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering