Growth weakness at home is helping on the external front of Brazil although export growth probably remains under pressure (at least in dollar terms). Going forward, gains on the export front is expected given the considerable depreciation of the BRL. As a result, the current account could be heading for a substantial correction this year in dollar terms. However, given the possibility that BRL depreciation this year could be over 30%, therefore, only a modest improvement in the current account balance to GDP ratio is likely to seen, says Societe Generale.

Moreover, the steep pace of decline in imports continues to indicate a serious deterioration in investment demand back home. A sustained improvement in the current account balance must be associated with continued improvements in exports. It remains to be seen whether BRL depreciation over the past year is sufficient to boost the competitiveness and growth of Brazilian exports to the extent needed to improve investment prospects.

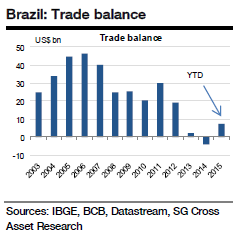

While year-to-date (YTD) Brazil's merchandise exports contracted 16.6% yoy, imports contracted more heavily by 21% yoy. As a result, the YTD trade balance improved from a deficit of -USD952m to a surplus of USD7,296m.

"On our forecast of -USD3,985m for August, therefore, we estimate that the YTD current account balance improved from -USD58.3bn to -USD48.1bn. As is clear from the numbers above, nearly 80% of improvement in the current account balance is driven by the merchandise trade surplus while the rest is driven by trade in services and income categories. This represents a nearly 18% yoy improvement in the current account balance", estimates Societe Genearle.

Brazil's current account improvement continues on falling imports

Tuesday, September 22, 2015 5:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns