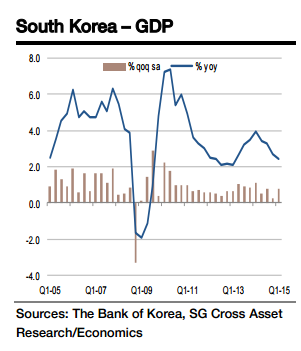

The release of advance GDP figures for Q2 2015 is basically set to be a non-event, as BoK Governor Lee Ju-yeol already disclosed a flash estimate of 0.4% qoq, at the press conference following the MPC meeting on 9 July. He attributed the significant slowdown in GDP growth to the MERS (Middle East Respiratory Syndrome) outbreak and the drought.

Growth in key components of Q2 GDP can be calculated using the H1 GDP growth forecasts in the BoK's macroeconomic outlook also announced on 9 July. Consumption is likely to have been the main driver of the GDP slowdown, with qoq growth falling from 0.6% in Q1 to zero in Q2, probably due to MERS concerns. Construction investment looks set to show still-healthy growth of 1.7% in Q2 after the volatile shifts of -7.8% in Q4 2014 and 7.4% in Q1 2015.

Facility investment is likely to have remained sluggish at 0.2% in Q1 and Q2, while both exports and imports of goods are set to show a pretty strong recovery of 1.3% and 1.1% each after the contraction in Q1. If these flash estimates are correct, we can conclude that the weakness in consumption overwhelmed the rebound in exports. In H2, the key thing to monitor will be whether the BoK's assumption of an instant recovery in consumption and the continued strength in exports proves to be correct or not.

BoK discloses dip in GDP growth due to MERS outbreak

Monday, July 20, 2015 1:19 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out