The summary of opinions by the Bank of Japan (BoJ) monetary policy board members published earlier today showed that majority of the board members are of the belief that Japan’s economy is headed for a recovery. BoJ board members saw improvements in exports, consumer spending and capital expenditure but warned that it may take time for inflation expectations to pick up.

The BoJ delivered no surprises at its February policy meeting, leaving in place the parameters of its yield curve control policy (-0.1 percent for the IOER and the around -0 percent target for the 10-year JGB yield) and of asset purchases, including the about ¥80 trillion per year for JGBs. There was no mention of the bank's ETF purchasing program, which presumably will continue unchanged. The BOJ has made clear it is not tapering its asset-buying program at this time.

"Since the second half of 2016, Japan's economic recovery has strengthened," one of the nine board members was quoted as saying. "Positive synergy effects are being produced by improvement in overseas economies, economic stimulus measures by the government, and enhanced monetary easing."

The BoJ in its statement following the policy meeting revised up its growth forecast but left the inflation projection unchanged (and very high compared to our and the market consensus forecast), implying that their inflation outlook has become somewhat cautious. The summary of opinions today showed that the bank does not have the intention of raising the target rate in the immediate future.

There was a sense of caution in the summary of opinions as members expressed concerns over uncertainty surrounding the Trump administration's policies and about Britain's exit from the European Union. Japan relies on trade demand for growth and Trump's protectionist trade policies could pose a threat to Japan because it exports large numbers of cars and car parts to the United States.

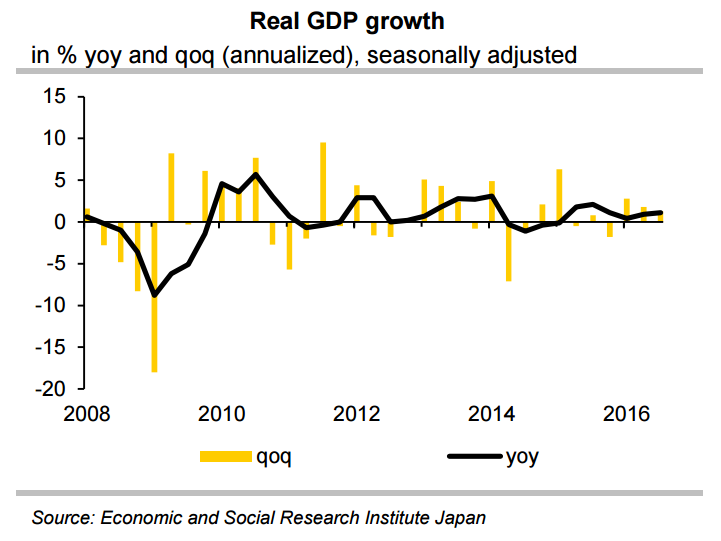

"In line with the BoJ policy members’ positive outlook that Japan is headed for a recovery, we expect the 4Q16 GDP result, to be announced on Monday 13 February, to further confirm that Japan’s economy continues to grow. We expect Japan’s 4Q16 real GDP growth to come in at +0.3% qoq or +1.0% qoq on an annualised basis." said Societe Generale in a report.

USD/JPY was trading in a narrow range on the day, currently at 112.20, while EUR/JPY was 0.43 pct lower at 119.49 at 1225 GMT. Yen is likely to remain buoyed on BoJ's upbeat economic outlook and increased safe haven appeal on political uncertainty in euro area. FxWirePro's Hourly JPY Spot Index was also at 130.27 (Highly bullish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record