The Bank of England's official interest rate has been at 0.5 percent since March 2009. The BoE is largely expected to leave policy unchanged when it meets on Thursday, Oct 8th, and the vote should be a repeat of last month's 8-1(McCafferty). The minutes are to be published simultaneously along with the policy announcement. In the drive for increasing transparency, the MPC now risks duplicating the message which perversely might dilute its impact.

"We believe the tone of the MPC could sound hawkish to some, as the MPC will want to lean against recent market expectations of it pushing back the date of the first hike into 2017. In particular, the MPC will insist that global woes will not derail the BoE's strategy given current domestic strength," said Barclays in a note to its clients

However, heading into the rate decision on Thursday, there have had a flurry of weak economic data out of the UK. Disappointing data comes at a time when the drop in the Fed rate hike bets is pushing BOE away from its liftoff. A much weaker-than-expected reading of the services sector purchasing managers' index (PMI) on Monday saw analysts cut forecasts for UK growth for Q3. And data released on Tuesday showed UK house prices dropped in September, highlighting subdued consumer demand. The latest PMI reports were also weak, showing weaker manufacturing and service-sector activity.

In the minutes of the September MPC meeting, the BoE stated that "Global developments did not as yet appear sufficient to alter materially the central outlook described in the August Report, but the greater downside risks to the global environment merited close monitoring for any impact on domestic economic activity .. concerns about China and other emerging economies had grown." This assessment of the situation in broad terms will likely be repeated in the minutes of this month's meeting.

There should again be some members who saw upside risks to inflation - obviously McCafferty but also probably Weale and Forbes. It is even possible that the minutes again will have a comment that one member saw the risks of a hike and a cut as evenly balanced. But, given Haldane's latest speech in which he said "In my view, the balance of risks to UK growth, and to UK inflation at the two-year horizon, is skewed squarely and significantly to the downside." the case for raising UK interest rates in the current environment is, some way from being made. One reason not to do so is that, were the downside risks to materialise, there could be a need to loosen rather than tighten the monetary reins as a next step to support UK growth and return inflation to target."

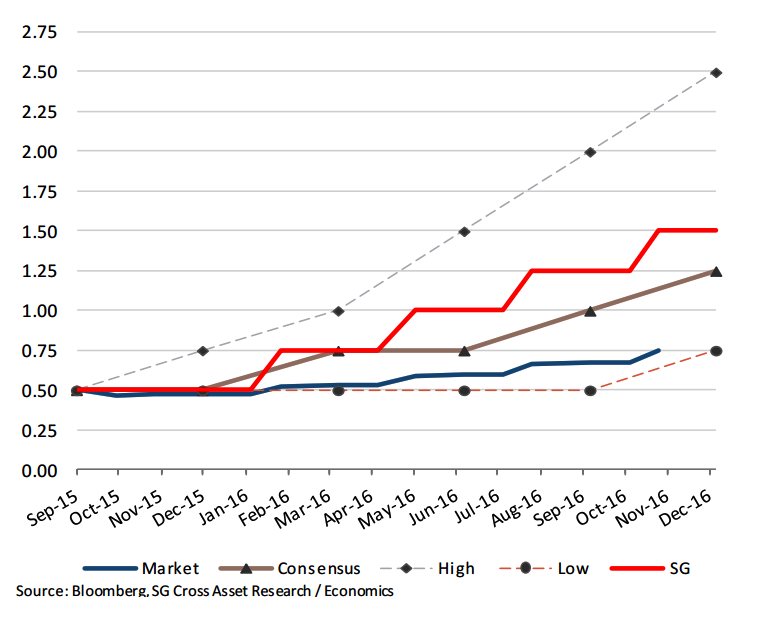

"The output gap is now only ½% and predicted to close within a year. This is a strong signal that the MPC plans a rate increase before long but even the hawks temper this message by the observation that the recent fall in inflation to around zero buys more time", says Societe Generale in a research note.

The pound was little changed at 73.93 pence per euro as of 1034 GMT, Tuesday, having reached 74.43 pence on Oct. 2, its weakest level since May 7. Sterling was up against the USD, trading at 1.5166.

BoE to stand pat, more comments likely about China

Tuesday, October 6, 2015 11:09 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings