Services sector remains the most prized asset of UK economy which generated more than $7 billion export surplus in 2014 and wage hike has been most prominent in that sector.

Now latest PMI report shows that growth has slowed in services in third quarter, which poses considerable doubts over Bank of England's (BOE) rate hike ambition next year. More so at a time when UK government is trying to protect its financial services industry from EU laws by negotiating Britain's relation terms with European Union (EU). On the other hand UK's leftists are pursuing hard to pose additional taxes on the sector.

Key highlights from PMI -

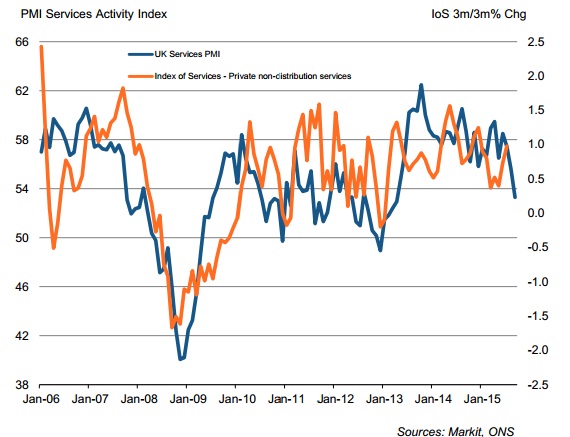

- September PMI confirmed weakest quarter for services since second quarter of 2013.

- New business growth has hit 29 month low.

- Only marginal rise in charges points to further weakness going ahead.

- Headline PMI points at continued growth in services but PMI dropped for third consecutive month to 53.3 in September, compared to 55.6 in August.

- Rate of expansion in new businesses slowed in five of the last six months.

- Expectations for new businesses dropped to 13 month low.

All is not gloomy

- Employment rose at strongest pace in last three months.

However, stronger rise in wages led to solid rise in input cost, which is likely to affect margin going forward if growth stalls.

Pound has taken hit over the report, dropped below 1.52, currently trading at 1.518 against Dollar.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate