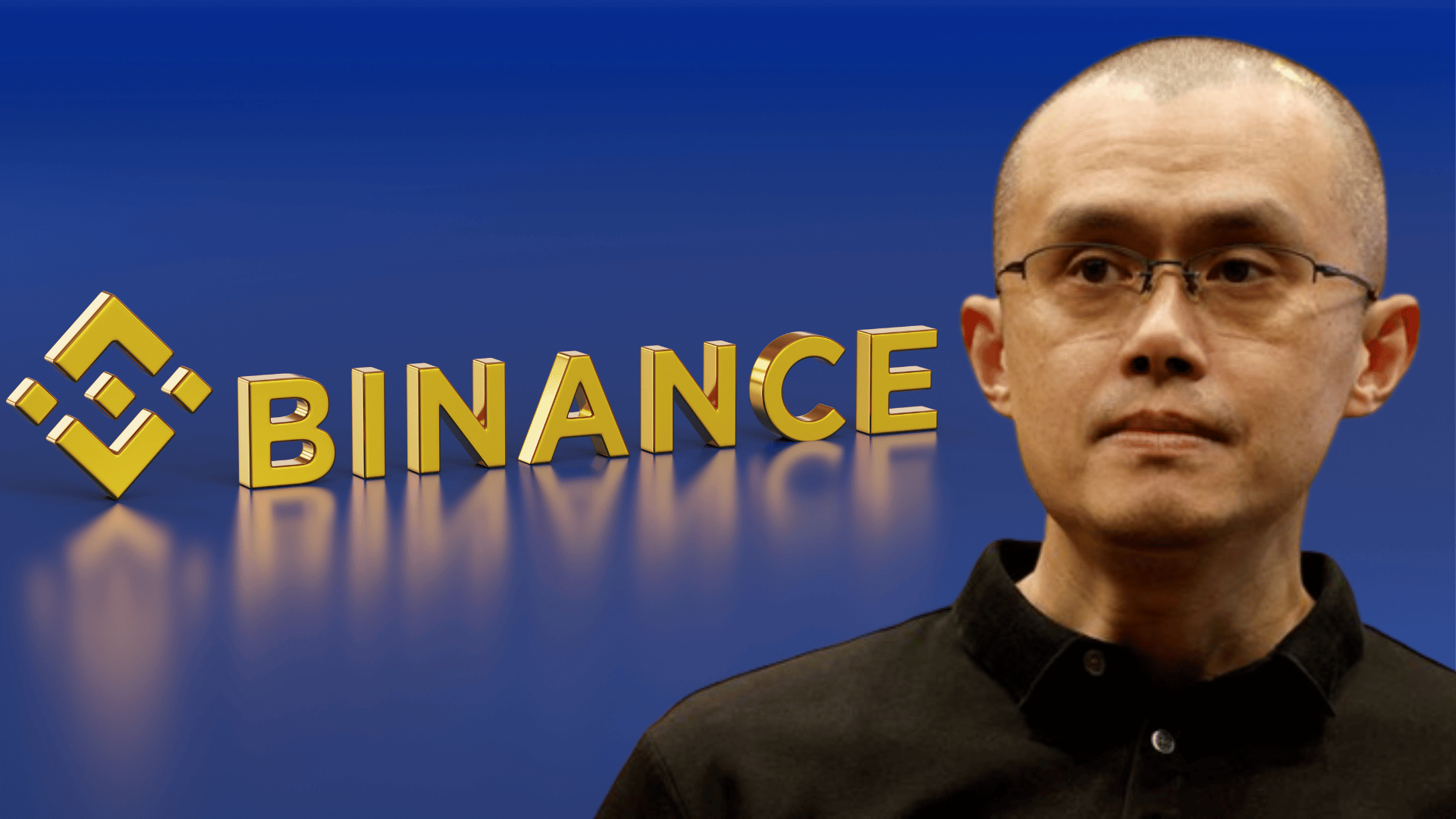

Recent events surrounding Binance, a major player in the cryptocurrency market, and its Chief Executive Officer, Changpeng Zhao, commonly known as "CZ," have triggered significant movements in the crypto world.

The company, grappling with legal challenges, has seen its CEO step down following a guilty plea to charges related to not adhering to Anti-Money Laundering norms. These developments come alongside a substantial financial settlement with the U.S. Department of Justice and the appointment of a new CEO.

Market Impact and Trader Reactions

The news from Binance sent ripples through the cryptocurrency trading community, leading to a tumultuous 24 hours. Data from CoinGlass, a platform tracking crypto derivatives, indicates that traders who had bet on rising prices saw nearly $175 million in liquidations, while those betting on falling prices witnessed about $51 million in liquidations.

In total, the market experienced over $226 million in liquidations, affecting 92,742 traders. The most notable of these was a $2.35 million liquidation on Bybit’s BTC/USD trading pair.

Changing Winds for Binance’s Assets

Along with these market upheavals, Binance's internal asset management also saw significant changes. DefiLlama, a data aggregator, observed a drop of over $1 billion in asset inflows to Binance in the same 24-hour period. This suggests that traders have become cautious about depositing their assets with the exchange in light of the recent events.

BNB Token's Brief Surge

Amidst this chaotic backdrop, Binance's cryptocurrency token, BNB, experienced a brief surge in value. Defying the general market mood, BNB hit a five-month high of $271.9, only to fall back to $234 the following day after news of the Department of Justice settlement broke.

This sudden increase, followed by a sharp decline, highlights the volatile nature of the cryptocurrency market, especially in times of major corporate and legal developments.

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’

Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies

Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies  Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth

Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation

Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation  U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors

U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns

Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns