The better-than-expected tax amnesty flows at the end of the first phase of the program (1 July to 30 September) have reduced the downside risks to growth given that the extent of cuts in expenditure will be smaller. Still, Bank Indonesia is expected to cut the 7-day reverse repo rate by another 25 basis points to 4.75 percent at the October 20 monetary policy meeting to counteract weakness in public spending and ease liquidity tightness in the banking system.

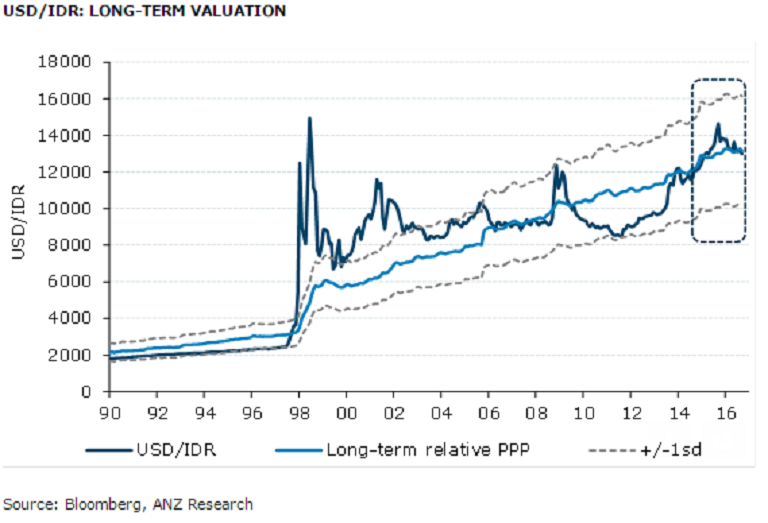

The good progress in the tax amnesty program has helped underpin sentiment even though fund repatriation under the program has been hovering at a low 4-5 percent of total funds declared. Clearly, there has been a boost to investor confidence although the impact on the IDR via actual conversion is modest, ANZ reported.

A firm and stable IDR bodes well for Indonesian government bonds. The reduced risk of a larger budget deficit has helped ease our concerns over bond supply. Indeed, given the healthy funding run-rate (90.0 percent) and a likely positive reception to the retail bond offer, the government may meet its full-year bond issuance target in November.

"We maintain our 2016 fiscal deficit projection at 2.5 percent of GDP. A significant fiscal slippage from the government’s 2.4 percent target is unlikely as we turn more constructive on tax amnesty revenues after the good take-up rate in the first phase," ANZ commented in its latest research note.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out