In response to the recent rise in currency volatility, Bank of Indonesia (BI) indicated at its August meeting that it would continue to ensure orderly market conditions through market intervention and, if needed, deploy macroprudential policy measures.

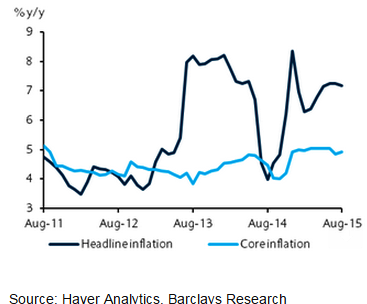

"Indonesian inflation is expected to stay above BI's target range in Q3 and gradually trend lower in Q4 on a lower base. In view of further upside risks for food as El Niño weather conditions develop in Q3, as well as growing concerns of stress on the currency, the central bank is likely to keep rates unchanged through 2015", says Barclays.

BI is expected to be reluctant to weaken the IDR in the near term to avoid adding to imported price pressures. During periods of stress, it could mount a more credible defence of the currency.

"While downward pressure on commodity prices have not subsided and China's growth remains modest, the recent cabinet reshuffle should give more impetus to the Jokowi administration's infrastructure push and drive growth in H2. The growth dividend from higher infrastructure spending will make a significant contribution from 2016 onwards, but will also keep growth in 2015 marginally above 5%", added Barclays.

Bank of Indonesia to be on hold through 2015

Tuesday, September 1, 2015 6:40 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.