The key takeaways from Thursday's meeting is that The Bank of England is now no longer tagging along with the Fed. The minutes show that 'As in previous months, there was a range of views among Committee members about the outlook for activity and inflation, and therefore the balance of risks around the inflation target in the medium-term'. The overall tone of the minutes suggested the Bank was at least a few months away from any move to start hiking rates.

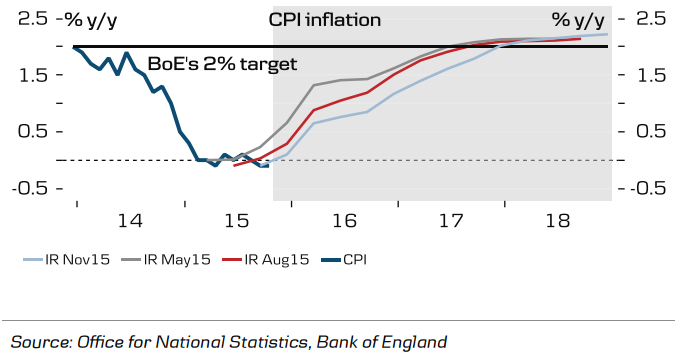

Policymakers are likely concerned over falling oil prices, which could keep inflation subdued. The minutes say that oil prices at the current level imply that 'the expected path of CPI inflation in the spring would be slightly lower than at the time of the November Inflation Report' and that 'The price of oil had fallen markedly again, increasing the likelihood that headline inflation rates would remain subdued'. This was not unexpected as the BoE also took a dovish stance after the oil price drop back in August.

Low oil prices that are close to seven-year lows as well as tumbling commodity prices have sent shivers through markets worldwide. The OPEC cartel decided last Friday against cutting output despite a global glut and weak demand, further denting outlook for oil. On the one hand the UK real economy is doing well with growth above trend, increasing employment and the unemployment rate more or less back to 'normal'. On the other hand, temporary factors such as the strong GBP and lower oil price are keeping inflation low and will continue to put downward pressure on CPI inflation going forward.

"As the hawkish BoE members have not been as hawkish as expected and since the oil price has lowered the inflation outlook, our call for a hike in Q1 16 has become very unlikely and thus we now expect the first BoE hike in Q2 16, probably in May 2016 in connection with the inflation Report (previously Q1 16, February 2016)", says Danske Bank in a research note.

But how long the BoE can afford to wait is the question. Unemployment is expected to fall below NAIRU during the spring. Wage inflation has fallen in recent months but this is more due to the volatility in the series than a sign of weakness in the labour market and it is expected to increase next year as the labour market tightens further. If the BoE waits too long to raise rates, inflation may be above target once the temporary factors begin to fade out of headline inflation.

"As we now expect BoE to hike two times in 2016 taking the Bank Rate to 1% by the end of 2016, we have revised our 3M EUR/GBP forecast higher to 0.71 (previously 0.68) as GBP now should see less support from relative rates in the coming months", adds Danske Bank.

GBP/USD is currently trading at 1.5138 as at 1140 GMT, consolidating after Thursday's spike, day's range 1.5168/25. EUR/GBP was at 0.7250 up from session lows at 0.7213.

Bank of England to hike rates in Q2 2016, likely in May

Friday, December 11, 2015 11:51 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist