Bank Indonesia (BI) will hold its policy meeting on Tuesday, 17 March. A rate cut is expected but the central bank unlikely will ease monetary policy aggressively this year.

BI Governor Agus Martowardojo has said that BI will maintain its tight monetary policy bias if inflation and the current account deficit do not improve.

Standard Chartered notes on Friday as follows:

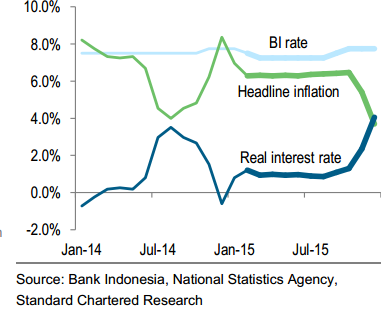

- We expect BI to cut the BI rate and the BI overnight deposit facility (FASBI) rate 25bps each to 7.25% and 5.25%, respectively, and to keep the BI overnight lending facility (repo) rate unchanged at 8.00%.

- We think favourable inflation dynamics will underpin BI's move. We expect inflation to slow to 3.7% at end-2015 from 8.4% at end-2014.

- However, we acknowledge the risk of BI postponing the rate cut until Q2-2015 given ongoing pressure on the Indonesian rupiah (IDR). We expect the BI rate to remain at 7.25% in Q2.

- Given that the Fed will likely hike the fed funds target rate in September, we expect BI to hike the BI rate 25bps in September and October to reach 7.75% at end-2015, to defend the IDR against the risk of capital outflows.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX