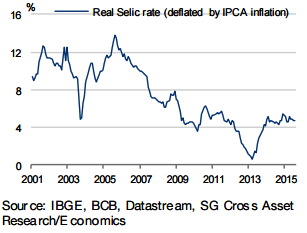

The key addition to the Banco Central do Brasil's (BCB) usual short post-Copom statement at the July meeting was - "The Committee understands that the maintenance of this basic interest rate level, for a sufficiently long period, is necessary for the convergence of the inflation to the target at the end of 2016 ."

"The market interpretation of this statement in the context of the current tightening cycle is that the BCB has decided to end the tightening cycle after raising rates to 14.25%. This interpretation might not be necessarily wrong as the last pause beginning in May 2014 (and lasted until October 2014) followed another surprise addition to April Copom statement", says Societe Generale.

"The Committee will monitor the evolution of the macroeconomic scenario until its next meeting, so that it then defines the next steps in its monetary policy strategy." (Copom statement - 2 April 2014).

"With the economy set to contract nearly 2% this year, medium-term growth expectations plummeting and the labour market deteriorating, the BCB may eventually find it difficult to avoid taking the middle path between growth and inflation", added Societe Generale.

BCB close to end its tightening cycle

Monday, August 31, 2015 7:24 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty