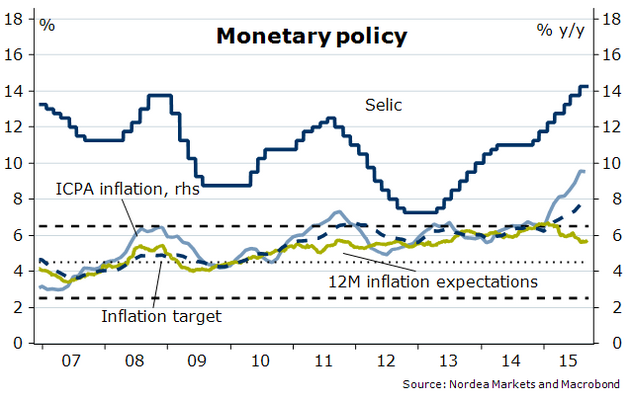

After hiking the Selic target rate by 325 bp to 14.25%, the Brazilian central bank (BCB) has signalled an end to its hiking cycle.

"We expect rates to be kept on hold this year and the BCB to start cutting rates towards end-2016 as the base effects from this year's tax hikes fade away and inflation comes down", says Nordea Bank.

Weak domestic fundamentals, increased political uncertainty, pressure from the drop in commodity prices and the upcoming Fed hikes will keep the BRL under pressure in the near term. Pressure should start to ease slightly in 2016 as the first Fed hike is out of the picture and sentiment around Emerging Markets improves, foresees Nordea Bank.

BCB indicates end to its hiking cycle

Wednesday, September 30, 2015 6:13 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022