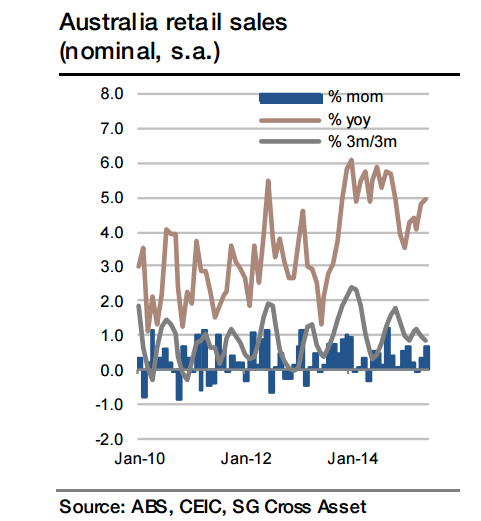

Australia's retail sales surprised on the upside in June with a 0.7% mom gain, despite a marginal (0.1%) decline in food sales, meaning that non-food sales jumped by 1.2% mom, their largest gain since January (food sales account for just over 40% of the total). Given the moderate gains in disposable income (2.6% yoy in Q1), retail sales growth of just short of 5% is unlikely to be sustained for long.

Hence, a moderate pull-back is expected in July non-food sales (-0.1% mom), which combined with a 0.5% rebound in food sales, implies a marginal 0.1% mom gain in overall sales. The weakness is likely to be concentrated in sales of household goods, which have seen an impressive run over the past year, partly on the back of the housing boom. One key downside risk comes from department store sales, which have in recent years seen dramatic volatility in July/August (with steep declines in July and August rebounds), though this did not occur in 2014.

Australia's retail sales consolidating after autumn surge

Monday, August 31, 2015 1:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks