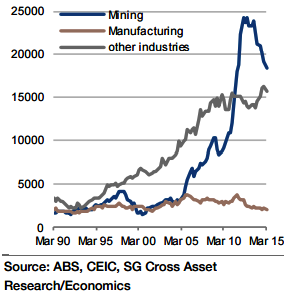

The big disappointment in Australia's Q1 private sector capital expenditure (capex) report was not the unabated decline in the mining sector, but the fact that the services sector fell back sharply. This is a one-off deterioration.

"After all, services exports are expanding solidly (by 9% yoy in Q2) and domestic private consumption expenditure is also holding up well. Hence, a notably smaller decline is expected in total capex in Q2 than in Q1", says Societe Generale.

However, much of the improvement is likely to have occurred in the buildings and structures component, which does not flow into the GDP calculation, rather than in the equipment, plant and machinery component, which is used in the national accounts.

"Much attention is likely to be paid to capex plans for FY 15/16, which began in June. It is hard to imagine that capex plans in the mining sector will have deteriorated even further from the -35% revealed in the Q1 survey, but not much improvement is expected either. In contrast, it is difficult to believe that capex plans in the services sector are really as weak as the Q1 survey suggested (-10% in 2015/16 compared with 2014/15), some improvement is awaited here", added Societe Generale.

Australia's mining sector capex slump to be partially offset by services sector

Wednesday, August 26, 2015 5:00 AM UTC

Editor's Picks

- Market Data

Most Popular