After falling quite heavily in recent months, Australia’s housing finance commitments posted a small rise in May. The investor segment contracted further, continuing the weakness in the wake of APRA’s macro-prudential policy changes.

The value of Australian housing finance commitments rose slightly in May, but not by enough to offset recent weakness. The value of monthly approvals is more than five per cent lower than a year ago. Investors are the main driver of this weakness, edging down another 0.1 percent m/m, while the owner-occupier segment is performing better (0.8 percent m/m).

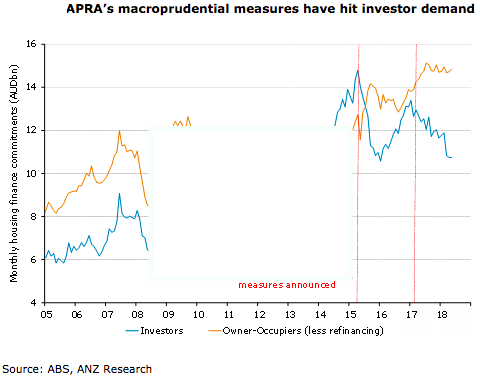

The fall in investor demand is clearly related to APRA’s macro-prudential policies. In 2015, the 10 percent speed limit on investor borrowing saw a sharp drop in the presence of investors, and the subsequent limit on interest only loans in 2017 has had a similar impact.

Even the removal of the 10 percent growth limit, announced at the end of April 2018, is unlikely to drive renewed strength. As a result, the share of new lending going toward investors is at the lowest level in several years.

"A central feature of our view on the housing market is that credit conditions continue to tighten through the remainder of 2018. This is expected to result in further weakness in housing finance going forward, which will in turn weigh on housing prices and building approvals," ANZ Research commented in its latest report.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions