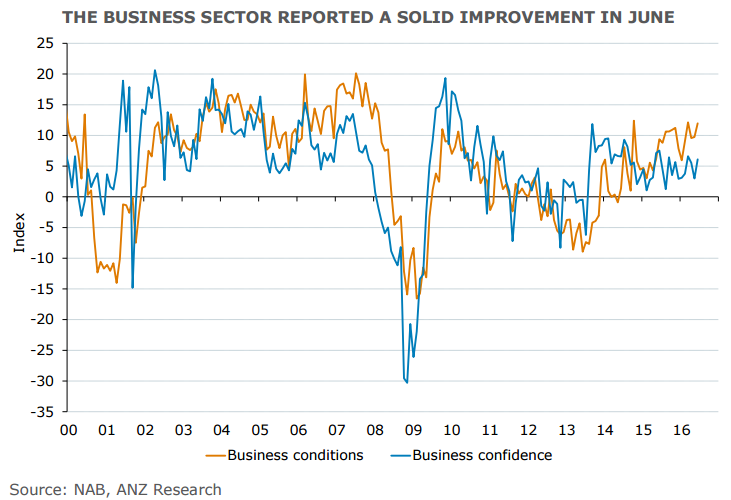

NAB’s closely-watched business survey for June tested the sentiment of local firms amidst the uncertainty of the federal election as well as the political unease in Europe and consequent market turbulence. The NAB business confidence index rose to 6.0 in May from 3.0 in the previous month. The index measuring forward orders and capital expenditure both improved during June. Business conditions also lifted from their already elevated level to +12 index points from +10 in the previous month.

The rise in business conditions was due to a notable improvement in employment demand, although profitability also rose, while trading conditions were unchanged at very elevated levels. Employment conditions are now back above long-run average levels, suggesting solid near-term employment growth. The results point to further improvement in the non-mining economy in Q2, with growth potentially becoming more broad-based.

“This suggests that firms are looking through external uncertainties, choosing to focus on the positives they see in their own business, at least for the time being,” NAB chief economist Alan Oster said.

The RBA should be reasonably comfortable with the present state of economic conditions and also the resilience of business confidence and business conditions in the wake of recent events that cloud the outlook. That said, inflation measures in the survey were broadly steady, although a drop in retail prices may have implications for CPI. Lacklustre views on inflation point to an opportunity for the Reserve Bank to further cut record low rates later this year.

Australia's inflation fell to multi-year low in Q1. In the first quarter of 2016, consumer prices fell 0.2% over the previous quarter, undershooting market analysts' expectations of a 0.3% increase and contrasting Q4 2015's 0.4% increase. NAB considers the report a mixed bag for the Reserve Bank to digest, with the lack of inflationary pressure leaving the door open to an August rate cut despite signs of robust economic growth.

“These trends justify the highly accommodative setting for monetary policy, but while the August RBA meeting (post Q2 CPI) is likely to be ‘live’, current information suggest rates will remain on hold — although it is likely to be a close call,” NAB said.

Aussie buoyed by robust data. AUD/USD hits new 2-week highs at 0.7637. Technicals support upside in the pair. The pair finds next hurdles at 0.7647 (June 24 high) and then at 0.7687 (78.6% Fib of 0.7835 to 0.7145 fall).

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook