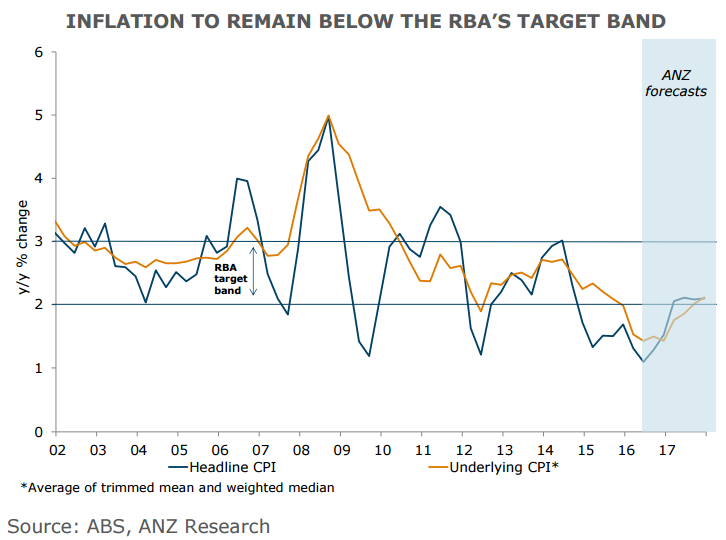

Australian government releases inflation data on a quarterly basis. Official Australia's Q2 CPI data is scheduled to be released on Wednesday, 27th July and are keenly awaited after the extremely weak Q1 print. Australia’s consumer price index weakened to an annualized 1.3% pace in the first quarter, the lowest since 2012. Should the Q2 CPI data disappoint, it would leave the doors open for a rate cut by the RBA at its August meet.

RBA in its quarterly Statement of Monetary Policy (SoMP) released in May cut its Dec-16 inflation forecasts by a full percentage point. Muted price pressures are consistent with the Melbourne Institute Monthly Inflation Gauge, which rose by just 0.1% in Q2, and ongoing deceleration in the NAB survey of retail prices. Melbourne Institute’s monthly inflation index provides a timely snapshot of consumer price trends in Australia showed June inflation expectations improved, but overall inflation remained well below the central bank’s target range.

“Inflation rose sharply in the final month of this quarter, and this was heavily driven by a significant rise in fuel prices. Given this rise, it seems unlikely that we will get a repeat of last quarter’s negative CPI result for the current quarter,” Sam Tsiaplias, senior research fellow at the Melbourne Institute, said in a statement.

The RBA reinstated an easing bias in July meeting, the minutes of which will be released tomorrow. Minutes likely to show RBA was concerned about the spike in market volatility following Brexit. International developments, financial market stability and the AUD will also be key discussion points at the August policy meeting.

NAB survey of business conditions last week was good, despite the survey being conducted during the UK’s Brexit vote volatility. Upbeat China’s GDP figures for Q2 appeared to suppress near-term easing speculation. In other words, the markets likely interpreted the data may lead the central bank to cut rates later rather than sooner.

"Underlying inflationary pressures are expected to have remained subdued, and well below the RBA’s 2-3% policy target band. Headline CPI is forecast to rise by 0.4% q/q and 1.1 y/y, boosted by higher petrol prices as well as administered increases for tobacco and private health insurance premiums. While the quarterly outcomes are forecast to be somewhat higher than in Q1, the average of the two core measures is forecast to decelerate to 1.4% y/y in Q2 from 1.5% y/y in Q1. Inflation outcomes are likely to be soft enough to keep an August rate cut on the table," notes ANZ in a report to clients.

AUD/USD is trading a narrow range, Doji formation seen on daily charts. The pair is trading a rising channel and momentum studies are bullish. Upbeat Q2 CPI data could take it higher to 0.7675. Should the Q2 CPI data disappoint a drag till 0.75 likely. AUD/USD was trading at 0.7589 as of 1000 GMT.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength