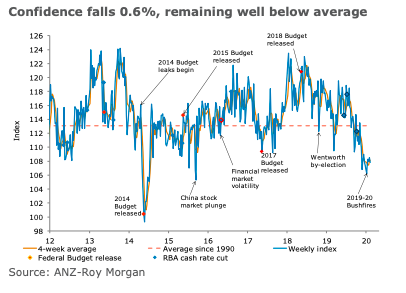

Australia’s ANZ-Roy Morgan consumer confidence fell 0.6 percent last week, reversing a bit over half the prior week’s increase. This continues the recent sawtooth pattern. Confidence remains well below average.

In a repeat of last week’s pattern, there were largely oversetting moves within the sub-components of financial and economic conditions. ‘Current financial conditions’ dropped 3 percent, while ‘future financial conditions’ were up 3.8 percent.

In a similar pattern, the 4.1 percent drop in ‘current economic conditions’ didn’t quite offset the 5.3 percent lift in ‘future economic conditions’.

‘Time to buy a major household item’ fell 5 percent, to its lowest level since mid-December. The four-week moving average of ‘inflation expectations’ was unchanged at 4.1 percent.

"Consumer confidence has displayed a sawtooth pattern in recent weeks, with offsetting moves in many of the components leading to a lack of overall direction. Last week’s upbeat assessment of the outlook by the RBA may have buoyed ‘future economic conditions’, which rose to their highest level since mid-November. ‘Future financial conditions’ also rose sharply, jumping to their highest level since early November. Sentiment around current conditions, though, was lower, as were views on whether it was ‘time to buy a major household item’. Heavy rain and floods in parts of the east coast and the coronavirus epidemic may have contributed to the weakness in these aspects of the survey. Overall, consumers are cautious, and it is difficult to see this lessening any time soon," said David Plank, ANZ’s Head of Australian Economics.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed