The Australian dollar has recovered against its U.S. counterpart during early European session Tuesday after having suffered a 4-month low, on the back of a weaker-than-expected consumer price inflation data (CPI) for the first quarter of this year, released early today.

The Aussie currency’s strength is further determined by fresh demand across all bourses as most cities in the East Coast continued to witness annual inflation above the 2 percent benchmark set by the central bank, wooing to solid gains in the food and housing sector.

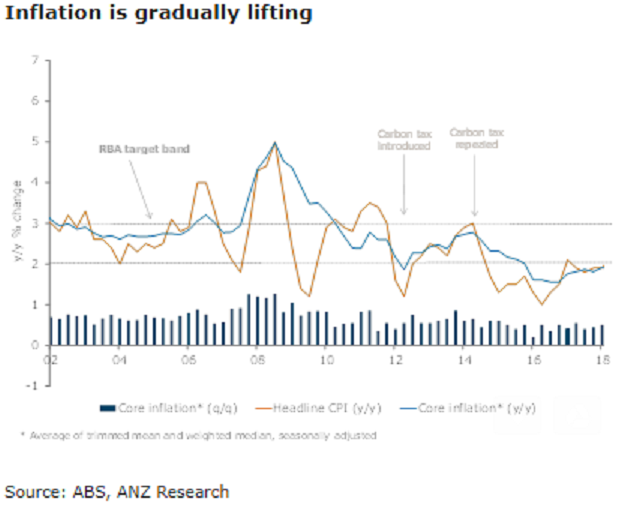

Australia’s headline CPI rose by 0.4 percent q/q, missing market expectations of 0.5 percent q/q and down from 0.6 percent q/q in the last quarter of 2017. Further, both the trimmed mean and weighted median rose by 0.5 percent q/q. On an annual basis, both headline and core measures were stable, but still just below the RBA’s target band.

Tradable prices fell by 0.4 percent q/q in Q1, while non-tradable prices rose by 0.8 percent q/q. However, there are no signs of retail price deflation easing. Retail prices ex fruit & vegetables and alcohol fell by 0.4 percent q/q to be 3.6 percent y/y lower over the year. Given this, the onus remains on an acceleration in wage growth to lift domestic inflationary pressures.

Further, the Q1 inflation data will support the case that monetary policy will remain on hold for some time and we foresee the cash rate to remain steady at 1.5 percent until May 2019.

"Our preliminary CPI forecast for Q2 2018 is for headline inflation to rise by 0.5 percent q/q, with core inflation also rising by 0.5 percent q/q," ANZ Research commented in its latest report.

However, as of 07:35GMT, the AUD/USD currency pair was again seen trading slightly on the downside, at 0.7599, in red by 0.03 percent.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination