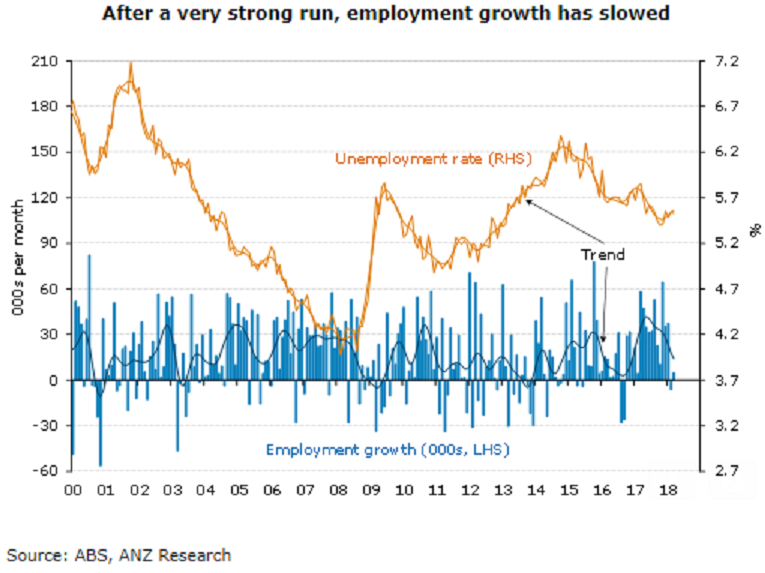

Australia’s employment index for the month of March rose, although downward revisions to February show that the record run of jobs gains is over. The slowdown in employment growth comes on the back of a very strong run through 2017 and with labor market leading indicators remaining positive, there are still reasons to be optimistic about the outlook for employment and unemployment this year.

Employment rose 5k in March, following a downwardly revised fall of 6k in February (initially reported as 17.5k). Today’s report shows that the record string of employment gains ended in January with the sixteenth straight rise.

The annual seasonal reanalysis also saw revisions to the unemployment rate. It printed at 5.5 percent for March, in line with the downwardly revised 5.5 percent reported for February (initially 5.6 percent). The participation rate ticked down from 65.6 percent to 65.5 percent, with both male and female part-rates edging lower.

The softer tone of the report was reinforced by the split showing full-time jobs fell a solid 20k in March, fully reversing the 20k gain in February. Part-time jobs rose 25k after a 26k fall in February. Looking through this monthly volatility, the trend in full-time jobs growth has slowed to flat from a peak of 0.4 percent m/m in August last year, while the trend in part-time jobs growth remains relatively solid at 0.3 percent m/m. Despite the weakness in full-time jobs in the month, hours worked rose 0.3 percent.

"Leading indicators continue to suggest that the labor market will gradually tighten further. Buoyant business conditions and ongoing strength in job vacancies suggest that employment will continue to expand and the unemployment rate should trend lower in coming months," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks