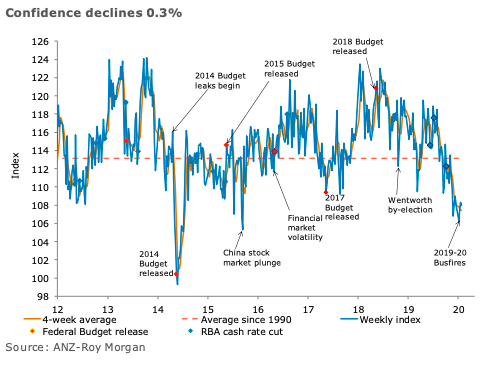

Australian ANZ-Roy Morgan consumer confidence declined 0.3 percent last week, after two straight weekly gains.

‘Overall financial conditions’ was flat, as a decline of 0.5 percent in ‘current finances’ was balanced by a similar increase in future finances.

‘Current economic conditions’ fell 1.8 percent, while ‘future economic conditions’ gained 3.5 percent last week.

‘Time to buy a major household item’ was down 2.4 percent compared to a gain of 4.7 percent previously. The four-week moving average of ‘inflation expectations’ was stable at 3.9 percent.

"Confidence declined modestly last week, despite the strong employment number. The news flow around the coronavirus and the potential implications for Chinese and Australian growth likely acted as a material offset to the more positive local news. There are a number of unusual influences on sentiment at present, such as the bushfires and coronavirus and the offsetting impact of strength in the labour market. This makes it more difficult than usual to assess how consumer spending will respond. We think this difficulty will see the RBA opting to wait for more information before it considers a further reduction in the cash rate," said David Plank, ANZ’s Head of Australian Economics.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom