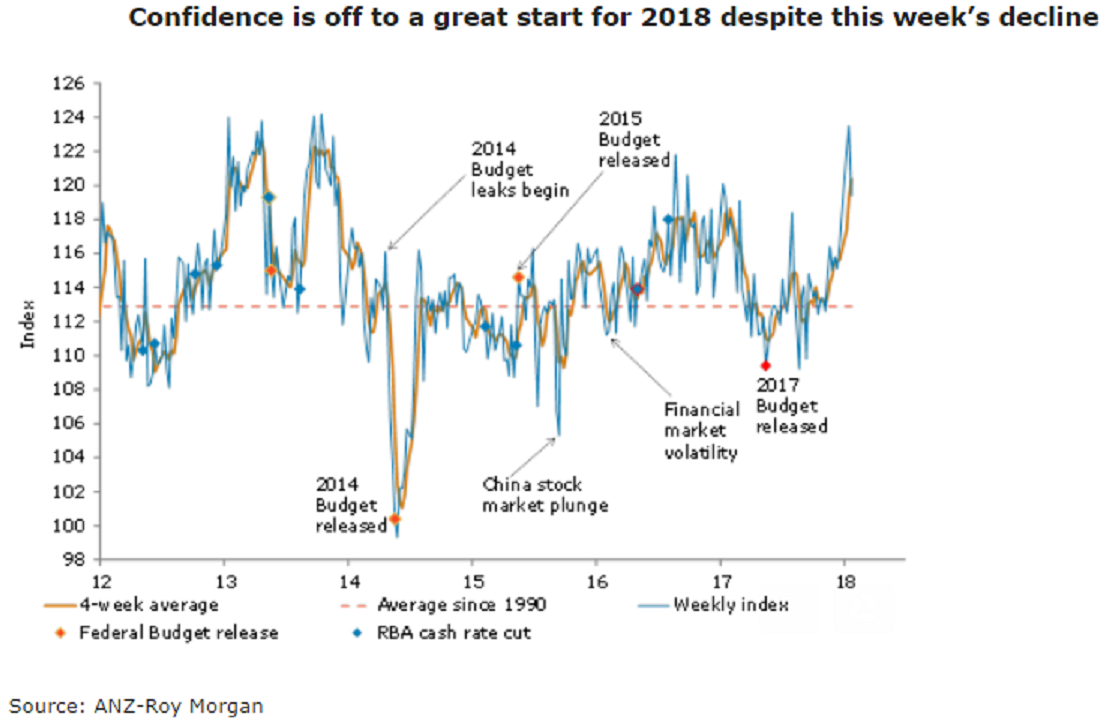

Australia’s ANZ-Roy Morgan Australian consumer confidence fell 3.3 percent last week following three consecutive strong reports. The fall was broad-based, with views towards current finances leading the pullback.

The current finances sub-index fell a sharp 9.1 percent to 104.7, partially unwinding gains over the previous three weeks. In comparison, views towards future finances fell a more modest 2.2 percent, following a 0.2 percent decline in the week prior. Despite the weekly falls, both sub-indices sit above their long-term average.

Households’ pessimism also extended towards the economic outlook. Views on current and future economic conditions dipped 3.6 percent and 1.3 percent respectively, though both sub-indices remain elevated compared to recent lows.

Sentiment around the ‘time to buy a household item’ slipped 1 percent last week following a 7.9 percent rise over the preceding two weeks. Four-week moving average inflation expectations edged up by 0.1 percent to 4.6 percent.

"Looking past the weekly volatility, we expect sentiment to remain supported by a strong labor market and a solid outlook for economic activity in 2018," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength