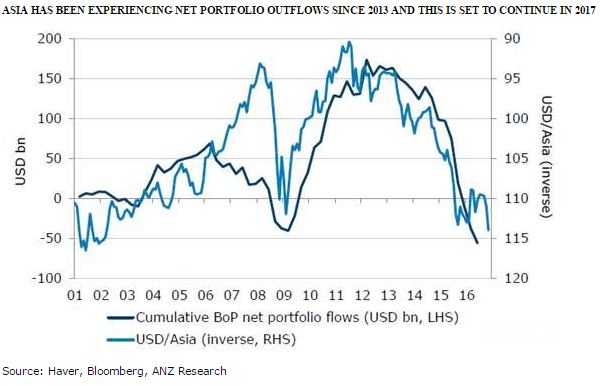

Asian currencies are expected to depreciate for the fifth straight year, going into 2017, following mounting global headwinds; also sharp appreciation in the greenback will pose serious threats to major Asian currencies.

Rising US interest rates on the back of continued policy normalization by the US Federal Reserve and prospects of fiscal stimulus from a Trump administration is set to keep the USD bid. Asian economic growth should eventually benefit from a better performing US economy. But a stronger USD and rising US yield environment tends to cause volatility in capital flows and pose a headwind to Asian currencies.

Further, there remain potential risks from a rise in the Chinese yuan, although Chinese authorities have put up efforts to keep the RMB index stable. According to the report, ANZ remains bearish on both KRW as well as SGD. The real effective exchange rates of both currencies are elevated given the state of their economic cycles. A re-centring of the policy band by MAS is likely in 2017.

INR’s and IDR’s macroeconomic fundamentals have improved such that they are less vulnerable to rising US yields compared to the taper tantrum period. But with both countries running higher inflation rates compared to their trading partners, some nominal currency weakness can be expected, though this is compensated by their higher yield.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality