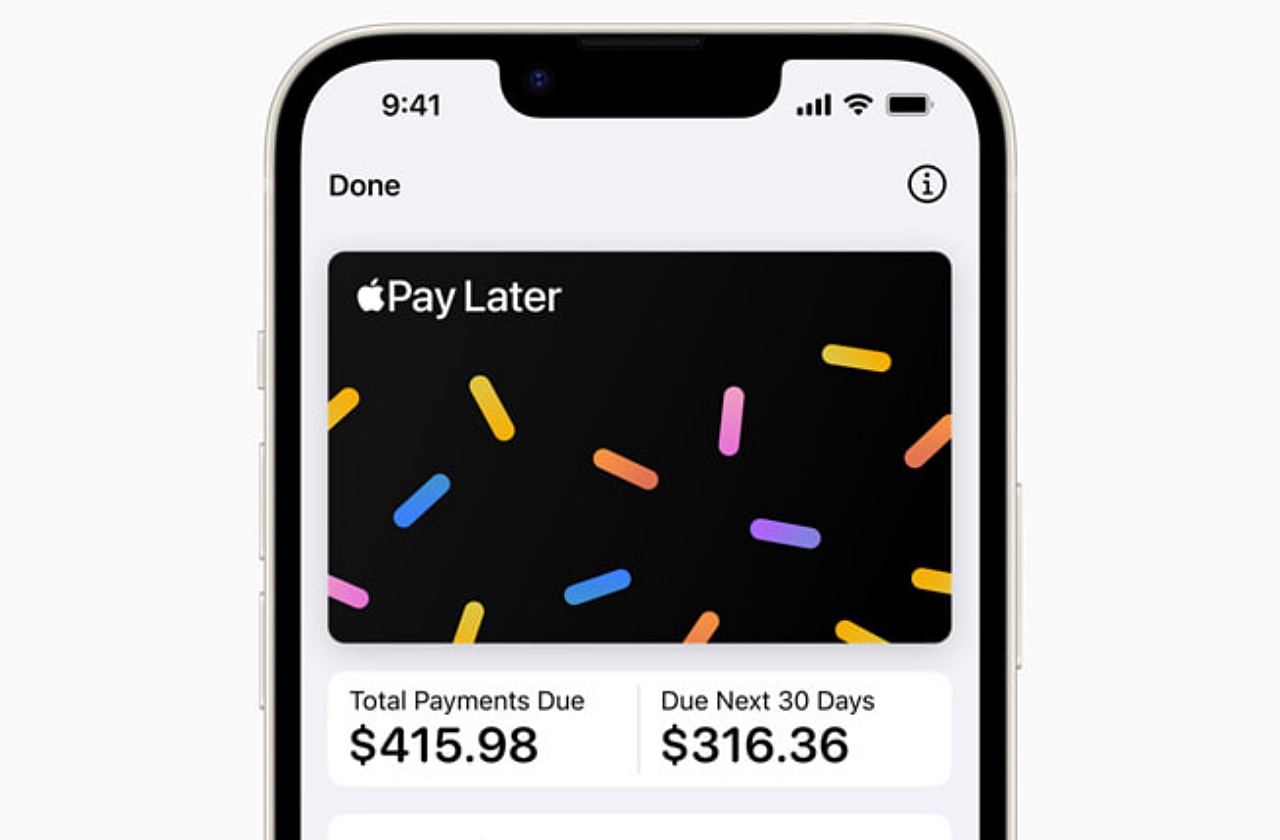

Apple Inc. announced on Tuesday, March 28, that it has rolled out a service that will give its Apple Pay users a new option to pay for their online purchases. The technology company based in Cupertino, California, said its digital wallet is now offering a buy now, pay later payment option.

With Apple’s addition of the new payment scheme that will allow users to pay in installments, it has become the latest major brand to dive into the buy now, pay later trend. The company said that through the BNPL plan, Apple Pay users could choose to pay in four installments with zero interest. Moreover, the company said there are no extra fees to pay for the service, according to CNN Business.

The iPhone maker said that the new feature on its digital wallet is called Apple Pay Later. Users can pay back the installments in over six weeks, and the first payment is due at the time of purchase. Moreover, another feature that users can enjoy from the BNPL plan is the loan.

Apple users can apply for a loan directly within the Apple Pay wallet app. The loan amount can range anywhere from $50 to $1000. The best part is that there is no interest or fees in online or in-app transactions.

Apple Pay Later will initially be available to select users in the United States. Apple will send invites to select individuals to access a pre-release version of the new Apple Pay Later this week. Later, the company will offer the service to all eligible customers, and this may happen in the next several months.

“There is no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we are excited to provide our users with Apple Pay Later,” Vice president of Apple Pay and Apple Wallet, Jennifer Bailey, said in a press release.

She added, “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs