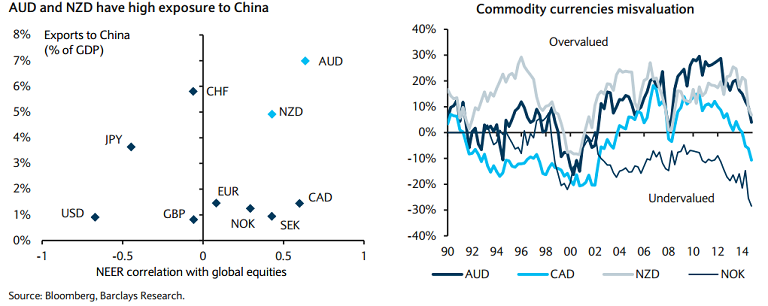

China is the largest trading partner for Australia and New Zealand, commodity exports make up a very large proportion of their GDP. As China rebalances its economy to shift into a consumption driven model, it is going to have a disproportionate impact on raw-material demand. Slowing Chinese activity and substantial CNY depreciation are likely to put downward pressure on the antipodean currencies.

AUD and NZD valuations look stretched at 4% and 7% respectively. The antipodean currency valuations have recently corrected sharply lower, and are likely to undershoot. Recent volatility has also highlighted the inferior safe-haven characteristics of the AUD and NZD, which rely on sentiment-sensitive capital account inflows to fund their current account deficits.

"We remain bearish all commodity currencies, the AUD and NZD look particularly vulnerable to further depreciation. They continue to suffer from slowing Chinese growth, a weaker CNY, lower commodity prices and elevated risk aversion", says Barclays in a trading note to its clients.

In the context of falling terms of trade, weakening trading partner growth, slowing domestic growth and extremely low inflation, RBNZ is expected to ease further this year. On the other hand, the RBA is likely to leave policy unchanged at historic lows, given continued financial stability concerns related to Sydney house price inflation and some signs of improvement in the labour market and non-mining sector.

With the Fed likely to begin its policy normalization later, in 2016, AU and NZ interest rate differentials with the US are still likely to narrow further and place downward pressure on the AUD and NZD.

"We recommend selling AUD and NZD against the USD and now expect them to depreciate a further 12% against the USD over the next year", notes Barclays.

Survey earlier today showed that preliminary Caixin/Markit China Manufacturing Purchasing Managers' Index (PMI) fell to 47.0 in September, the worst since March 2009 and below market expectations of 47.5. The bleak reading reinforced concerns of a sharper-than-expected slowdown in the world's second-largest economy and spurred selling of commodity currencies.

Australia's benchmark ASX 200 index has slumped more than 2 per cent on the day, dropping below the 5,000-point level, on very weak Chinese manufacturing data. The Australian dollar fell 0.9 percent against the USD to $0.7026, against the yen it shed 1.2 percent to 84.14. The Kiwi also remains heavy versus its American counterpart, with NZD/USD testing lows near 0.6260 at 0800 GMT.

Antipodeans vulnerable to further depreciation

Wednesday, September 23, 2015 10:31 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary