Happy Lunar New Year. Happy year of the monkey.

All hopeful of a great year for China.

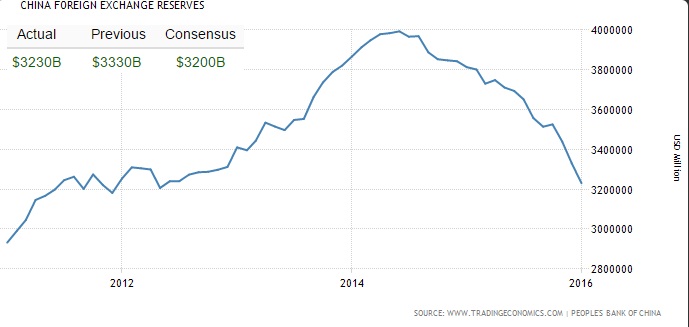

However, latest data, FX reserve released on the eve of New Year shows, another tough year lies ahead of Chinese economy. From 2005-2014 (first quarter), People's Bank of China (PBoC) struggled to manage the inflow of money and appreciation, now its facing much greater challenge to manage the outflow and inevitable depreciation of Yuan.

Data, shows, it is just like everyone had expected. Probably even better than many expected. China's FX reserve shrank by $99.5 billion in January and brings total reserve down to $3.23 trillion, lowest in three years.

What has been concerning everyone is the sheer size of capital account outflow, which is surpassing billions of Dollars of current account surplus. China's FX reserve has been key source of whatever stability China has, so faster the drawdown, greater will be worries.

While January's reserve depletion was grossly expected, it would be interesting to see the magnitude in February, when markets are relatively stable, China closes for weeklong holiday and PBoC exerting better grip on Yuan and rates. China's stock market is relatively stable too. If the calmness persist but PBoC still suffer large drawdown on reserve, it would be ever more concerning.

Focus is likely to return on China after week long New Year Holiday, next week.

Chart courtesy, Trading economics and Soberlook.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices