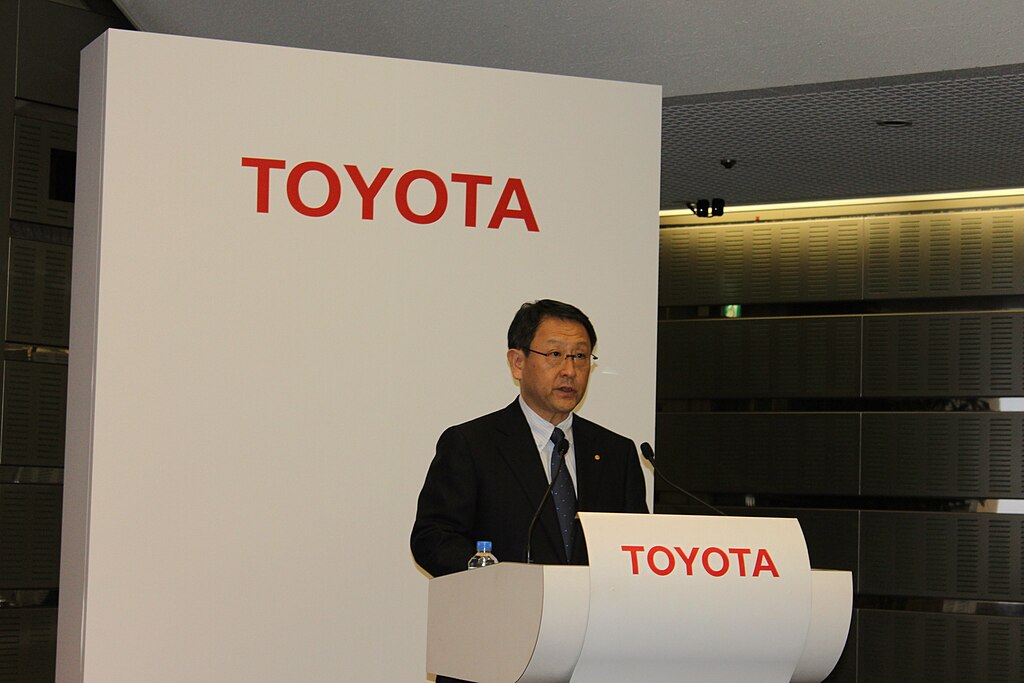

Toyota Motor shareholders re-elected Akio Toyoda as chairman on Thursday, reflecting strong support from individual investors despite controversy surrounding the company’s ¥4.7 trillion ($33 billion) bid to acquire Toyota Industries. The decision came as proxy advisory firms Glass Lewis and ISS—who had previously flagged governance issues—did not oppose Toyoda’s reappointment this year, marking a shift in sentiment.

Toyoda, the grandson of Toyota’s founder and former CEO, was widely expected to retain his role. While the vote breakdown hasn't been disclosed, it remains unclear whether support surpassed last year’s record-low 72%.

The re-election comes amid criticism from foreign investors over Toyota’s plan to take forklift-maker Toyota Industries private. The ¥16,300 per-share offer has been called undervalued by some overseas shareholders, who argue it consolidates power within the founding family. Despite not sitting on Toyota Industries’ board, Toyoda has committed to invest ¥1 billion of his own funds in the buyout, which aims to restructure Japan’s largest corporate group.

Toyota Motor defended the acquisition, stating it will foster deeper collaboration without the pressure of short-term profits, aligning with its long-term mobility vision. A shareholder attending the AGM in Japan noted that Toyota had provided enough information on the deal through its Toyo Times platform and expressed confidence in the company’s future.

Support for Toyoda has declined over recent years, falling from 96% in 2021 to 72% in 2023. In a prior interview, Toyoda acknowledged his leadership could be challenged if backing continued to wane.

Founded in 1926 as Toyoda Automatic Loom Works, Toyota Industries originally focused on looms before evolving into the automotive powerhouse that spun off Toyota Motor.

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs