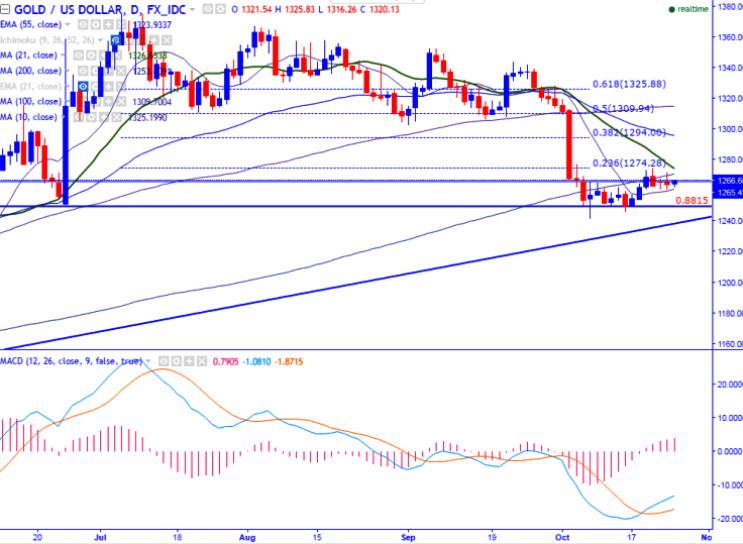

- Major resistance- $1275 (23.6% retracement of $1375 and $1241).

- Major intraday Support - $1250

- Gold has once slipped slightly after jumping to $1271.18 level on account stronger dollar and rising expectations of the rate hike . It is currently trading around $1265.99.

- The yellow metal has gained slightly yesterday but unable to hold at higher levels on Fed rate fear. According to federal fund futures chance of rate hike in Dec meetings is at 73.6%. US dollar index trades slightly lower after making a high of 98.85.It is trading around 98.72 .

- On the higher side, major resistance is around $1275 (23.6% retracement of $1375.15 and $1241) and any break above confirms minor trend reversal. Any violation above targets $1277/$1284.58 (21- day MA).

- The support is at $1250 and any violation below will drag the gold till $1226 (161.8% retracement of $1241 and 1264.93)/$1210.The minor support is around $1260.

It is good to sell on rallies around $1265-$1267 with SL around $1275 for the TP of $1250/$1241