The Turkish lira rallied yesterday after CBT surprised markets by keeping rates on hold at its MPC meeting. But as the pair rallied today, the last week’s gains are almost wiped off when the dollar looked good today again.

In all six previous meetings, the CBT had been issuing token cuts to its overnight lending rate, which have acted as a symbol to the government.

The pause was preceded by remarks by the president’s economic advisors that there is less pressure on the CB to cut rates.

This was surely an attempt to calm down the lira, which had been under pressure lately. This could mark a turning point.

Governor Murat Cetinkaya emphasized that lira movements had limited the scope for inflation to improve.

Perhaps Turkish economic policymakers, including the central bank, have decided to follow the example of cautious central banks which have managed to break inflation-exchange rate spirals. Of course, this is early days.

There is a huge difference between skipping one rate cut and true willingness to hike rates if necessary.

CBT’s recent history means that the new MPC would need to demonstrate credibility over a longer period of time. This is why the lira rallied today, but not massively.

Option Strategy:

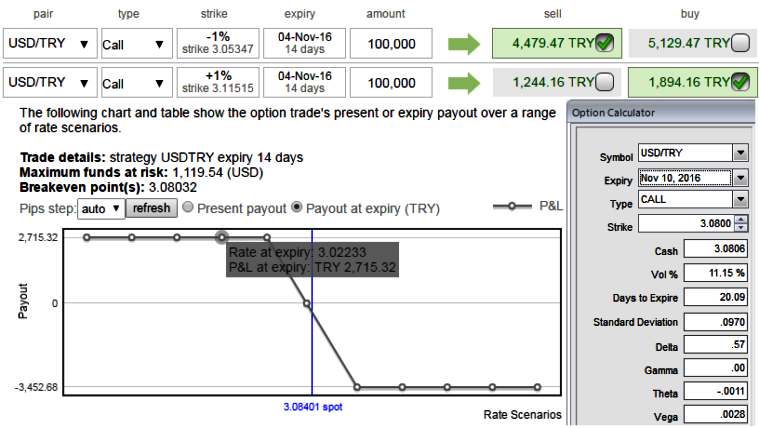

In the recent past, a credit call spreads with diagonal expiry was advocated and for now, we continue to maintain the same strategy.

2w ATM IVs of USDTRY is crawling up at 11.15%, ITM calls seem to be overpriced more than these IVs.

Thus, as shown in the diagram, it is advisable to initiate Diagonal Credit Call Spread (DCCS) in order to tackle both short-term dips and major uptrend.

Execution: Keeping the both fundamental and technical factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when USDTRY spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios