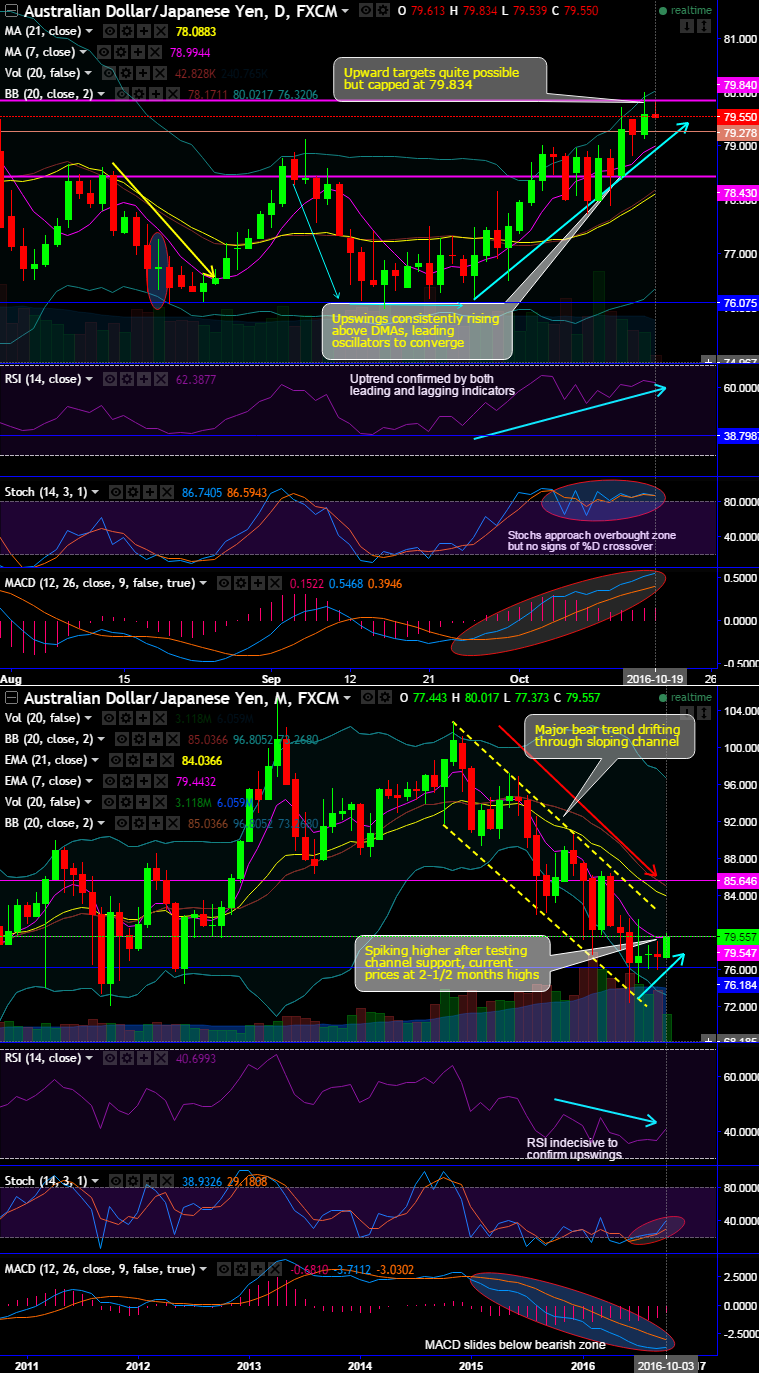

AUDJPY has rejected below resistance at 79.834 levels with a likely gravestone doji formation, currently, the bears have again snapped the recent gains at the same resistance levels.

The current upswings have consistently been rising above DMAs, leading oscillators are also converging to these price gains.

Daily RSI shows the strength in the ongoing rallies, whereas, stochastic curves approach overbought zone but no signs of %D crossover. MACD signals the extension of bull swings in the short run.

On a broader perspective, you can figure out from the monthly plottings, the current prices have consistently remained well below EMAs. Current prices on monthly terms are at the same juncture now (7EMA) sensing the stiff resistance.

Consequently, every attempt of recovery has been showing weakness at these MA curves which would be deemed as the strong supply zones.

To understand the major downtrend, last month, during the convincing rallies of AUDJPY bears pulled back at 77.506 mark (strong resistance at 79.837 levels),

Spiking higher after testing channel support, current prices at 2-1/2 months highs.

Thereby, after bull rallies that have lasted from last 4 months sensing a little weakness to signify long term bear trend's momentum. More room for shorts after the rejection of 79.834, capture rallies for fresh short build up.

Trade Tips:

Contemplating the above technical reasoning, we think boundary binary options are the right choice of speculation for the day that optimally utilizes the bullish sentiments in the short term and the major downtrend.

Upper strikes – 79.834; lower strikes around 79.278 levels.

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential from spot FX.

For this speculative position, the options would be exercised as long as the forward prices remain between both strikes (i.e. 79.837 > Fwd price > 79.278).