- Swiss franc recovered sharply against US Dollar yesterday on Geo political tensions between U.S and North Korea. U.S President Donald Trump warned North Korea that U.S is ready to meet threat with “fire and fury like world has never seen”. Swiss franc which is considered as safe haven shown a good rally.

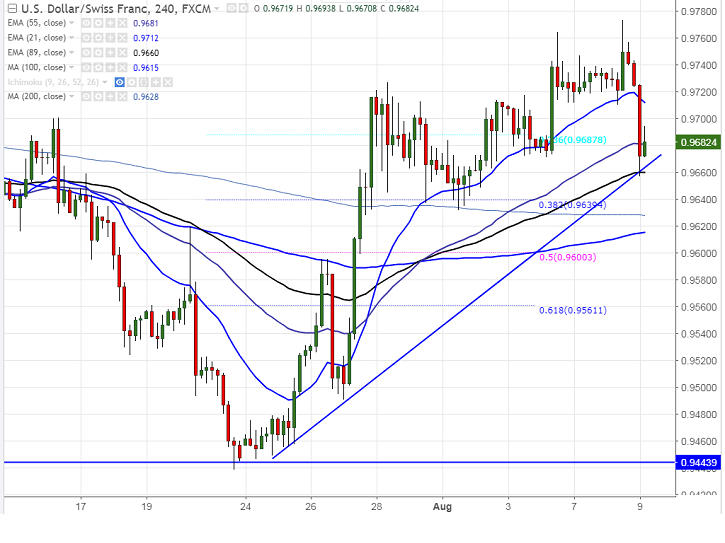

- USD/CHF declined sharply from the high of 0.9783 (38.2% retracement of 1.03432 and 0. made yesterday to 0.96565. The pair has taken support near 0.96500 (21- day EMA) and any break below will drag the pair till 0.9600/0.9560 in the short term. The bearish continuation can be seen only below 0.94385.

- On the higher side, near term major resistance is around 0.97708 (Jun 15th high) and any convincing break above will take the pair till 0.9808/0.9845 (61.8% fibo).

It is good to buy on dips 0.9675 with SL around 0.9625 for the TP of 0.9780/0.9847.