Dollar index trading at 98.65 (+0.33%)

Strength meter (today so far) – Euro -0.05%, Franc -0.27%, Yen +0.5%, GBP -0.5%

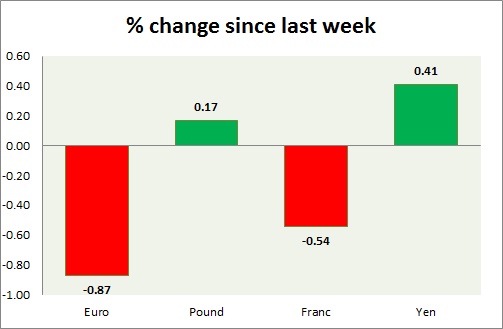

Strength meter (since last week) – Euro -0.87%, Franc -0.54%, Yen +0.41%, GBP +0.17%

EUR/USD –

Trading at 1.098

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.06, Medium term – 1.08, Short term – 1.09 (broken)

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.132

Economic release today –

- Flash consumer confidence will be released at 14:00 GMT.

Commentary –

- The euro is continuing its drop since the ECB press conference. The euro is the worst performer of the week. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. However, in the short run, Euro might ride higher.

GBP/USD –

Trading at 1.226

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.25, Short term – 1.24

Economic release today –

- Public sector net borrowing for September came at £10.12 billion, higher than expected.

Commentary –

- The pound gave up some of the gains but still positive against the dollar this week. In the short term, we expect the pound to drop towards 1.2 area. We expect the pound to reach parity.

USD/JPY –

Trading at 103.6

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 98

Resistance –

- Long term – 111, Medium term – 107, Short term – 107

Economic release today –

- NIL

Commentary –

- The yen is the best performer of the day and the week. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar if BOJ intervenes.

USD/CHF –

Trading at 0.988

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.995

Economic release today –

- NIL

Commentary –

- Franc is performing better than the euro. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term. However, this call is under threat currently. We could soon revise the call.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022