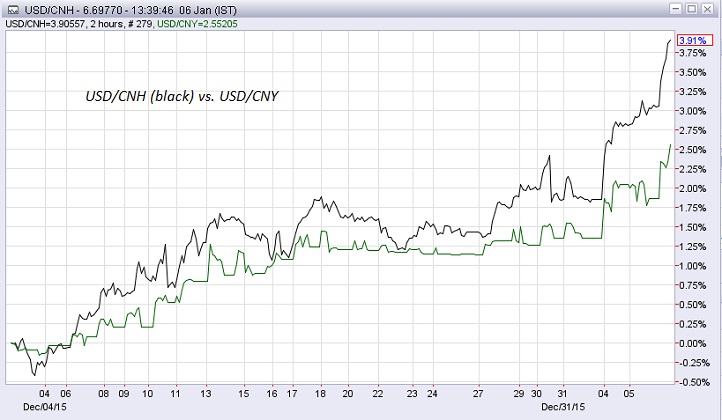

Offshore Yuan, which is largely traded in Hong Kong, has dropped to its lowest level since September 2010, a time when it was first introduced. Today, offshore Yuan depreciation is showing no signs of back down. It is already 0.8% down against Dollar. It is on its biggest daily decline against Dollar, Since August last year, when PBoC devalued its currency by record amount of 1.9% in a single day.

Year-end hasn't been good for Chinese economy. According to Caixin data, December manufacturing contracted at faster pace with headline coming at 48.2. Services data released today showed similar picture. Expansion was minimal with headline at 50.2, lowest level since August 2014. Weakness in China's manufacturing, might also leading to stalling growth in services sector, which has been expanding since August, 2014 and was as high as 53.8 in last August.

A 7% drop in China's stock market on first trading day of the year has made markets jittery already and continued depreciation in Yuan is likely to keep the mood sour.

Capital account outflow from China might have gained pace again. Last month, PBoC's FX reserve shrank by $87 billion, despite high current account balance and positive FDI inflow, suggesting pace of outflow to be quite large.

Offshore Yuan is currently trading at 6.695 per Dollar and onshore version at 6.57 per Dollar.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022