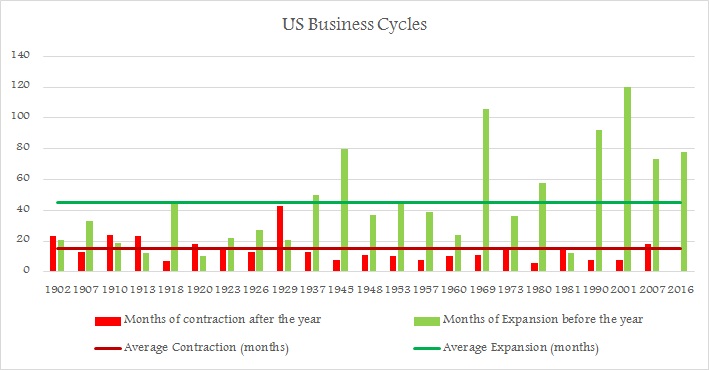

Last time US faced business cycle contraction dates back to 2007, at a time of great recession, which finally ended in June 2009 and it has been expanding since then.

Though it is very difficult to gauge how the world would have been without the support from US Federal Reserve, but one thing can be said with some degree of certainty contractionary cycle could have been much larger. In 2007 business cycle contracted for long 18 months, which is higher than last 115 years average of 15 months but much lower than that occurred during great depression, when business cycle contracted for record 43 months, according to data from National Bureau of Economic Research (NBER).

So key questions worrying us, as FED and other central banks are coming to the end of monetary policy expansion viz. a viz. support, is it going to be the end for expanding business cycle, especially since corporate profits are in decline.

Latest US business cycle that has been expanding, has now continued growth for 78 months, much higher than 45 months average of last 115 years.

However, what giving us hope, business cycles' expansionary leg has increased in average since 1970, averaging around 71 and last three business cycle averaged about 95 months, in thanks to 120 months long expansion before dot com bubble burst.

Nevertheless it is vital to recognize, we are slowly closing into rarest of the stretch (check figure).

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions