Yes you are reading it right.

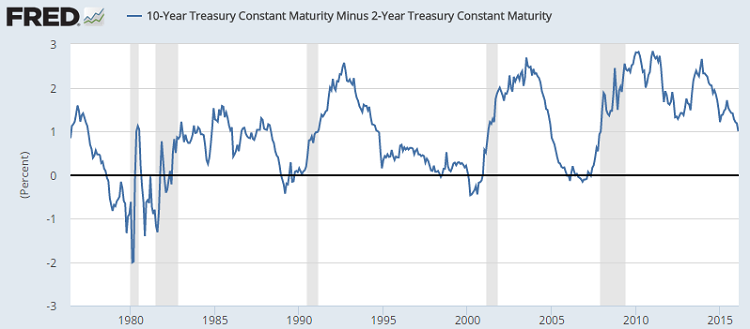

US treasury market, which has been a successful predictor of US recession in the past is just shy of 100 basis points from indicating a recession.

Since 2014, due to lower oil price and fading expectations over rate hike from US Federal reserve, as well as a drop in inflation reading has led to flattening of the yield curve. Moreover, since June, 2015 Yield curve flattening has fastened, more so this year as global equities have tumbled.

Now US yield curve is closer to jump from flat to getting inverted, which is yield is higher in the short dated treasuries than longer dated ones. Spread between 2 year treasury and 10 year treasury is at 1%.

Last time this has occurred was back in 2006, before 2008 recession and before that back in 2000, before 2001 recession that followed dot com bubble burst.

We have also discussed several other indicators such as Total business sales, industrial production, record mergers and acquisitions, all pointing to possibility of impending recession.

So this narrowing is making us more worried.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength