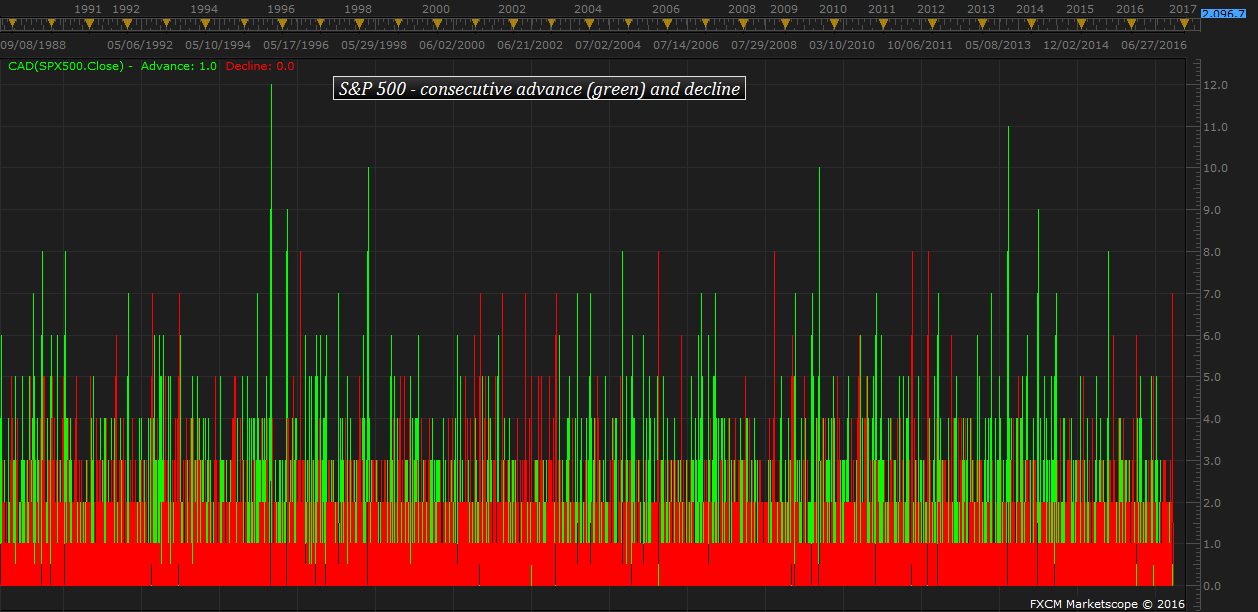

US benchmark stock index, S&P 500 has been declining since 25th of October and it has declined for the past seven days, facing a looming rate hike from the US Federal Reserve, uncertainties surrounding the US election (the prospect of a Trump win), and dwindling bond prices. This is not a regular phenomenon. If it declines again today, it could be a major warning of turmoil ahead.

There have been only five cases in past three decades, where the S&P 500 has declined for eight consecutive days and all of them were followed by financial turmoil and in some cases grave financial crisis. The very last time, the S&P 500 has declined for eight consecutive days is back in 2011/12, during European debt crisis and US budget crisis. Before that, it was 2008 and we all know, what happened then.

S&P 500 is marginally higher today so far and we would maintain a cautious outlook as seven days of decline are not common too. There have been seven cases in past 30 years.

The chart was created in FXCM marketscope

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX