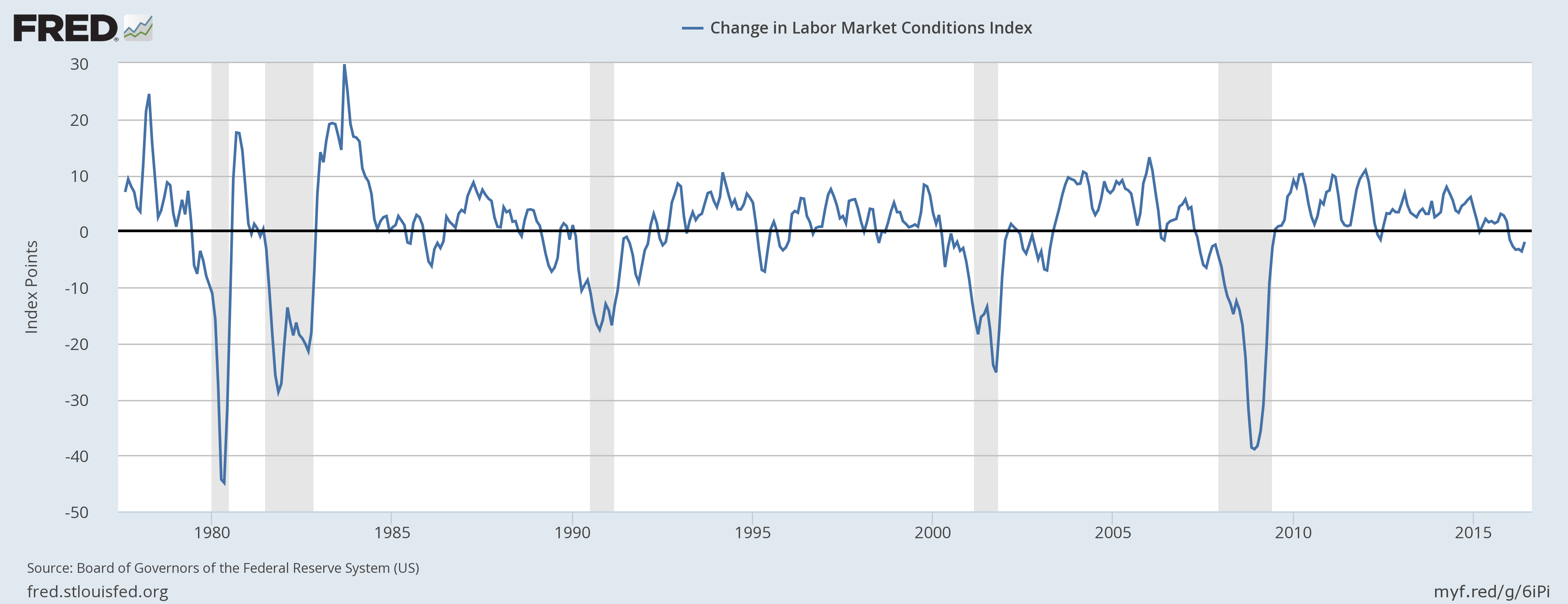

Labor market condition index (LMCI) that was developed by the U.S. Federal Reserve in 2014 to better track the conditions prevailing in the U.S. labor market is sending worrying signals. The LMCI is derived from a dynamic factor model that extracts the primary common variation from 19 labor market indicators. This year the index has been pretty weak.

In January 2016, LMCI has declined to negative territory and hasn’t been in the positive since. In May it bottomed at -3.6, the worst reading since the 2008/09 crisis.

The index since 1977 (back calculated using data) has dropped to negative 12 times (including the current) and in 8 cases it has been for long (more than 6 months) and deep. And in 5 instances among these 7 (excluding the current) the drop has been followed by deep recession.

LMCI became of the many indicators that have been warning the possibility of a recession in the United States. Focus is on today's payroll data to see what it points to - recovery or recession.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran