While the benchmark stock indices in the United States continues to break into higher highs, some analysts in the market have been issuing warning flags. Here are the current key concerns,

- The S&P 500 Cyclically Adjusted Price to Earnings (CAPE) valuation has only been greater on one occasion, the dot com bubble. It is currently on par with levels preceding the Great Depression of 1929. CAPE is currently at 30.27

- CAPE valuation, when adjusted for the prevailing economic growth trend, is more overvalued than during the late 1920’s and the late 1990’s.

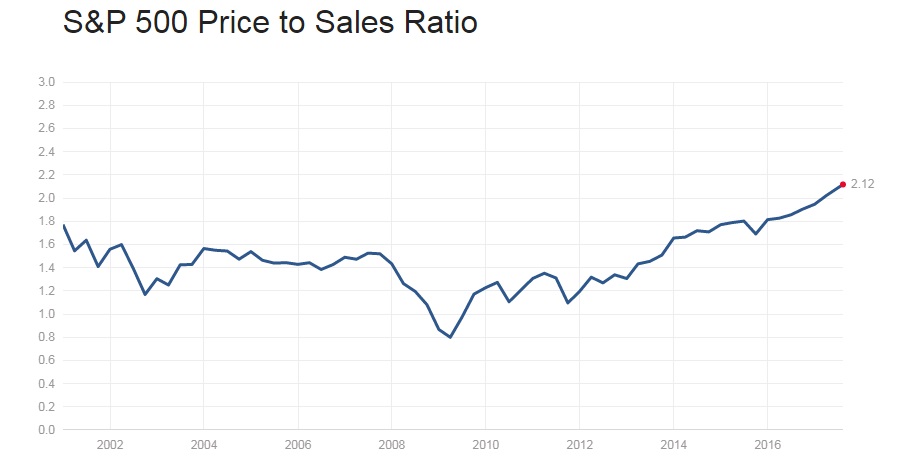

- S&P 500 Price to Sales Ratio is at an all-time high.

- Total domestic corporate profits have grown at an annualized rate of .097% over the last five years. Prior to this period and since 2000, five-year annualized profit growth was 7.95% that included two recessions.

- Over the last ten years, S&P 500 corporations have returned more money to shareholders via share buybacks and dividends than they have earned.

- The top 200 of S&P 500 companies have pension shortfalls totaling $382 billion and corporations like GE spent more on share buybacks ($45 billion) than the size of their entire pension shortfall ($31 billion) which ranks as the largest in the S&P 500.

- Using data back to 1987, the yield to maturity on high-yield (non-investment grade) debt is in the 3rdpercentile. Per Prudential as cited in the Wall Street Journal, yields on high-yield debt, adjusted for defaults, are now lower than those of investment grade bonds. Currently, the yield on the Barclays High Yield Index is below the expected default rate.

- Implied equity and U.S. Treasury volatility has been trading at the lowest levels in over 30 years, highlighting historic investor complacency.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed