Survey done by Nielson, on behalf of Reserve Bank of New Zealand (RBNZ) shows that inflation expectations have dropped to record low in first quarter survey. Reserve Bank of New Zealand (RBNZ) in its communications have indicated that it expects current interest rates to remain at 2.5% for some time now, however today's survey results are suggesting that the bank might have to do more to keep inflation in check.

Latest reading shows, inflation is at 0.1%, well below the RBNZ's target range.

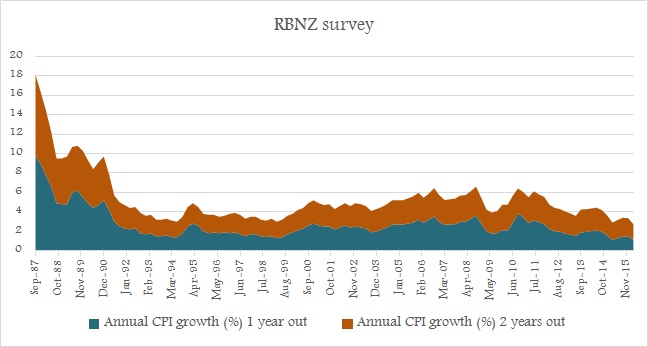

- Survey showed inflation expectations one year ahead dropped to 1.09%, lowest reading since data goes back to 1987. Similarly inflation expectations two year ahead, dropped to 1.63%, which is lowest reading since 1994.

- Survey on some other parameters show, GDP is expected to grow 2.43% one year ahead and 2.56% 2 year hence. Unemployment rate is expected to decline to 5.75% in a year and 5.64% in two year. Expectations from 10 year government bond yields have also reached lowest point ever to 3.21% and 3.34% for one year and two year ahead.

Despite worsening inflation outlook, due to growing concern over housing sector might keep RBNZ to stay put in the near term and cut rates by another 50 basis points between H2, 2016 and H1, 2017. Moreso, because yen shows cutting rates may not be enough to weaken Kiwi, if Dollar drops.

kiwi is currently trading at 0.66 against Dollar.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022