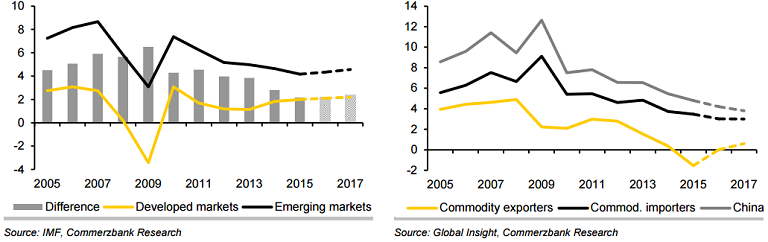

In the aftermath of the 2008-09 global financial crisis, emerging markets had gained the status as saviors of the world economy. But ever since the mid-2013 'taper tantrum', the emerging markets have disappointed and there is no dispute that 2015 has been a dismal year for emerging markets. After peaking in 2010, GDP growth in emerging markets has decelerated continuously. EM GDP growth is now at a six year low falling from 7.5% in 2010 to 4% in 2015. What is more worrying is the difference in GDP growth between emerging markets and developed markets is now at a 15-year low.

However, unlike in the past four years, growth differential between the emerging markets and developed countries will probably not narrow any further in 2016. Indeed, given the expectation that commodity prices will stabilise, the pace of GDP decline in countries such as Brazil and Russia is unlikely to be as sharp in 2016 as in 2015.

In fact, current account deficits in many troubled EM economies have already been silently correcting and inflation is not a problem. Some countries have been undertaking structural reforms and it is only a matter of time before these changes show some positive results. If the China story turns around, global trade, Asian economies and commodity producers would all see the benefits. The knock-on effects could also shore up the Russian and the Brazilian economies, both suffering severe recessions.

That said, there are other emerging markets in which the premium of GDP growth relative to the developed countries will likely narrow further in 2016. This is primarily due to slowdown in China, which accounts for 38% of emerging market GDP. The IMF calculations show that debt levels have particularly risen in the case of state-owned companies. The government is likely to prevail upon state-owned banks to keep highly indebted companies afloat, but the Chinese economy is set to expand at a comparatively low rate for several years and not recover rapidly.

There is also a third group of emerging markets, the commodity-importing countries (excluding China), which have profited from falling commodity prices in recent years and have more or less maintained their growth advantage over the developed countries.

"If commodity prices do not fall further in 2016, as we expect, commodity-importing emerging markets will lose this tailwind. They are also likely to suffer from the fact that higher interest rates in the US mean that a decade of cheap money is coming to an end", notes Commerzbank in a research report.

Will EM-DM growth differential narrow further in 2016?

Tuesday, December 29, 2015 11:36 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary