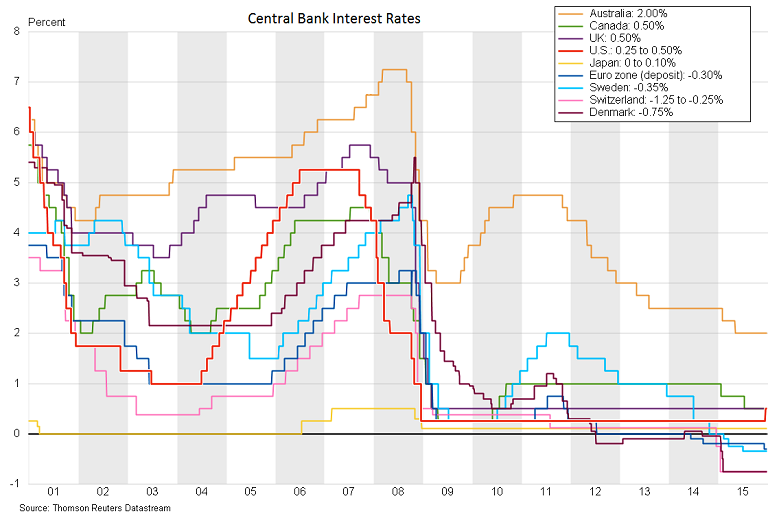

Fed's long-awaited rise in rates from zero showed confidence in the world's largest economy, but first post-crisis rate hike is an unlikely cure for what ails the rest of the world. With exchange rates dominating the policy debate in many countries, what happens to the dollar will matter a lot. A Reuters survey of 120 economists forecast the Fed would hike rates again in March, but probably won't move as quickly next year as policymakers have suggested.

Euro zone is finally generating modest growth and unemployment has begun to fall post massive ECB stimulus. Inflation however remains well below target, and so ECB stimulus, including the negative deposit rate, is likely to remain in place through 2016. That puts the world's largest trading bloc -- and most other central banks -- on an opposite policy path to the Fed.

China is already having a hard landing from years of over-investment in unproductive manufacturing plant and speculative real estate. Emerging world markets are also majorly reeling on account of the crash in the cost of commodities. Given the slowdown in China and the gloom surrounding emerging markets, economists point to global growth averaging only 3.4 percent next year with scant prospect of touching 4 percent.

"The key question is whether the U.S. economy is finally robust enough not only to sustain its own recovery but also to lift world trade and global growth enough to allow the external deflationary pressures weighing on U.S. inflation to wane," outlined HSBC economists Janet Henry and James Pomeroy.

Modest growth in developed economies offsetting persistent weakness elsewhere but generating very little inflation and keeping interest rates low. Collapse in oil prices, which has taken the price of crude back to levels last seen in 2004 has two beneficial effects for the global economy. It provides additional spending power for households and businesses that consume energy, and it bears down on inflation.

With no sign that Opec will agree to production curbs, it is quite possible that prices could fall below $30 a barrel in the early months of the year, thereby keeping inflation lower than any of the world's major central banks are anticipating. It will then become harder to raise interest rates if inflation continues to undershoot official forecasts.

Some emerging market economies are performing better. India is forecast to grow at a decent pace, underpinned by rate cuts earlier this year. And optimism about Mexico has also grown as it slowly starts to take advantage of a recent historic reform in the energy sector. But Brazil one of the biggest economies in Latin America is in serious trouble, is a country to watch out for.

"As if predicting exchange rates and interest rates wasn't hard enough, a strong El Niño may be arriving. So economists and investors will need to keep an eye on the weather, too." warned BofA-ML head of global emerging markets fixed income strategy, Alberto Ades. "

Will gains in mature economies offset emerging markets gloom in 2016?

Monday, December 28, 2015 11:34 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate