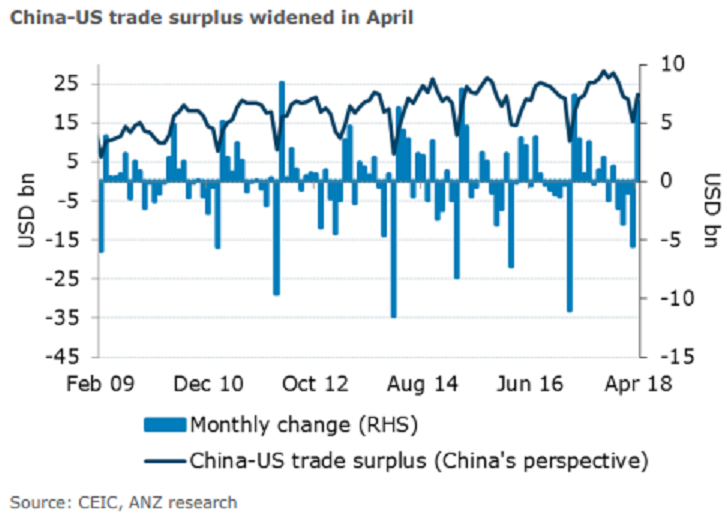

The widening China-US trade surplus reflects the difficulty of significantly closing the trade gap between the two countries in the near term, but it is unlikely to obstruct the constructive progress made recently, according to the latest report from ANZ Research.

The trade surplus between China and the US widened by USD6.8bn from March to USD22.2 billion in April, after having declined for four consecutive months. Despite some seasonality in the data, it also reflects the difficulty of achieving a compromise between the two countries (for example the US requests a narrowing of the bilateral trade balance by USD200 billion by 2020).

The exports of electronics were steady in April, likely due to some frontloading of shipments amid China-US trade tensions. Contrary to expectations, the exports of electrical products and automatic data processing increased 15.0 percent y/y and 22.4 percent y/y in April respectively, up from 2.4 percent and 15.2 percent in March.

Import growth extended its strong momentum, supported by major commodities and high-tech products imports. As was expected, the imports of major commodities, including iron ore and crude oil, have started to rebound in April (import volumes up 0.8 percent y/y and 14.7 percent y/y, respectively) as domestic business activities gradually resumed after the Lunar New Year holidays.

Natural gas imports also surged 214 percent y/y (in terms of volume) in April, more than triple the pace in Q1. High-tech products imports reported another double-digit growth, rising 27.5 percent y/y in April, exemplifying China’s economic transition from the low-end to high-end value chain.

"Nonetheless, we believe the high-level visits between the two (including Chinese Vice Premier Liu He’s upcoming visit to the US next week) are constructive moves in the right direction to resolving the trade tensions," the report added.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions