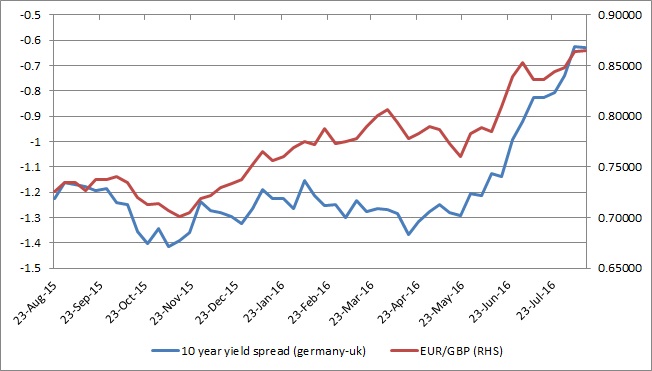

The euro has moved to a new post-referendum high against the sterling, which is also the highest level for the pair (EUR/GBP) since August 2013. As the UK gilts take a sharp turn up and yields plunge the yield spread between the European benchmark German bund and the UK gilts have widened. This has been one of the factors that have been pushing the pair higher and it will continue to do so as the focus has turned once again towards monetary policy divergence, especially after the Bank of England (BoE) launched its comprehensive easing package earlier this month.

The yield spread (10-year german-10-year UK) has narrowed from -137 basis points in April to just -63 basis points as of now. Meanwhile, the Euro has gained from 0.77 against the pound in April to 0.865 as of now.

Our first target to buy the euro at 0.76 against the sterling targeting 0.84 area has already been reached, however, we have extended our targets to 0.96 area in response to the referendum outcome.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX