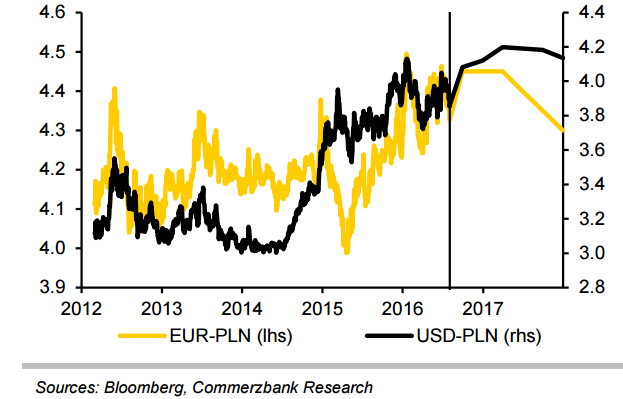

Volatile swings in risk sentiment about Poland’s government policy are possible. Therefore, wide volatility in the EUR/PLN is likely in the coming year around a central level of 4.45, noted Commerzbank in a research report. In 2016, there have already been sharp upward swings to levels near 4.50 earlier in the January-February period and also a rally back to levels near 4.25.

The alternating bouts of worsening political risk perception and impact of external developments are mainly driving these changes. Amongst the recent external development is the Brexit vote, which was a negative shock. Also, a small FX loan conversion plan from the Polish government stimulated risk sentiment.

“We still see EUR/PLN returning back to around 4.30 by the end of 2017 as policy visibility improves,” added Commerzbank.

Wide volatility in EUR/PLN likely in coming year

Wednesday, August 3, 2016 1:15 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX